Coinbase ($COIN): Q4 Earnings and Outlook for 2026

Coinbase is building durable infrastructure beyond trading, but near-term volatility and optimistic forecasts skew the risk-reward to the downside.

Hey Fundamental Investors,

We realize digital finance is lacking in strong sell-side research on the top crypto equities and tokens and so we’re bringing back deep dives by world class analysts.

We’ve previously published Fundamental Deep Dives on:

Coreweave

Circle

MicroStrategy

Figure

Today, our analysts’ are sharing a new memo on Coinbase ($COIN), still the clear leader in U.S. crypto markets and the most institutionally embedded gateway to on-chain finance.

Coinbase is expanding well beyond exchange economics — into stablecoins, subscriptions, custody, derivatives, and Base — positioning itself as critical infrastructure for the next era of digital finance.

But timing matters.

Our analysts’ view is that Coinbase remains highly cyclical, and consensus expectations for 2026 still look too high given ongoing pressure in brokerage fundamentals and the lagged impact of the current drawdown.

Long-term, the franchise is real.

Near-term, the return profile does not yet compensate for the risk.

Without further ado, here is the memo on Coinbase:

Overview

We do not recommend investing in Coinbase at this time, as we do not believe the current return profile adequately compensates for the risk. While Coinbase remains the clear leader in the U.S. market, with a strong institutional presence, regulatory positioning, and a defensible domestic moat, the timing of entry is critical.

Looking at prior crypto selloffs, earnings downgrades and multiple compression typically extend beyond the initial price correction, as weaker assets per account and softer trading activity flow through financial results with a lag. We expect a similar dynamic in the current cycle. With continued pressure in brokerage fundamentals and a high probability of earnings misses in FY2025 and FY2026, the downside risk remains meaningful. Although the long-term franchise value is still there, the near-term volatility and expected misses in earnings lead us to conclude that the expected return does not sufficiently compensate for the risks at this stage of the cycle.

Business Overview

Coinbase is a centralized crypto platform that historically generated most of its revenue as a broker, intermediating digital-asset trading for retail and institutional clients. The platform matches customer trades with liquidity providers, uses public blockchains to record and settle asset ownership, and integrates with the traditional banking system to enable fiat on- and off-ramps.

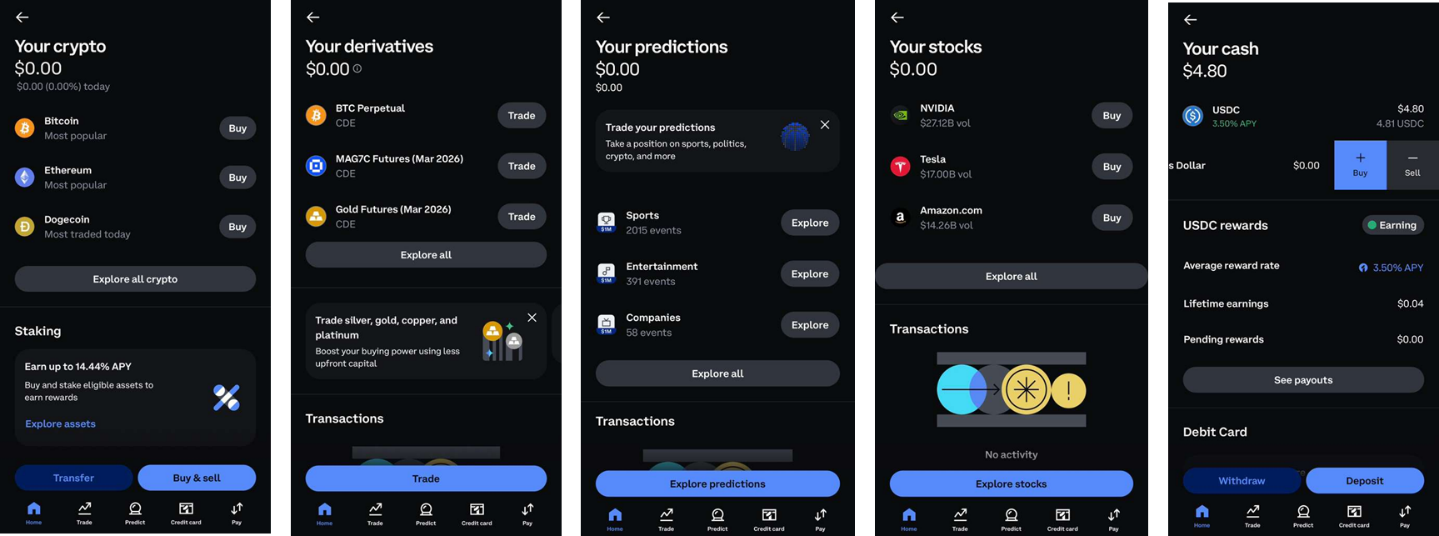

While trading remains competitive and cyclical, Coinbase is now deliberately expanding beyond pure exchange economics into broader crypto financial infrastructure, with several initiatives increasingly embedded directly into its core app. These include Coinbase One, a subscription product offering zero-fee trading and enhanced services to drive recurring revenue and customer retention; prediction markets (partnership with Kalshi), which extend Coinbase’s derivatives and event-based trading capabilities; and tokenized equities, enabling blockchain-based access to traditional financial assets. Alongside existing businesses such as institutional custody and prime brokerage, staking and on-chain yield, stablecoin distribution and payments, and derivatives, Coinbase is also building application and settlement rails through Base, its open-source, permissionless Ethereum Layer-2 network.

Collectively, these initiatives aim to increase customer engagement and lock-in, particularly at the institutional level, diversify revenues toward more recurring and infrastructure-like streams, and reposition Coinbase from a transaction-driven broker to a platform and gateway connecting traditional finance with on-chain markets.

Primary segments

1. Transaction Revenues

56% of revenue | 36% six-year CAGR | TAM: $27B (2024)

Transaction revenues represent Coinbase’s core brokerage business, where the company holds approximately 14% market share. Revenue is generated through trading fees and spreads applied to transaction volumes on the platform.

Trading volumes are driven by total platform assets, which stand at approximately $516B, split between 42% retail and 58% institutional clients. While institutional clients account for the majority of asset growth, retail clients remain a disproportionate source of profitability due to materially higher trading spreads.

Retail spreads: ~154 bps

Institutional spreads: ~6 bps

Institutional clients trade through Coinbase Prime, a separate product suite offering advanced execution algorithms, smart order routing, and over-the-counter (OTC) block trading. These clients require more sophisticated infrastructure but generate lower per-dollar economics, reinforcing the importance of retail participation to overall margins.

“Coinbase stands out as the only platform equipped for large traditional institutions. For banks, asset managers, and sophisticated firms that prioritize trust, security, longevity, and a real account team, Coinbase has a clear advantage in the U.S. through its brand, perceived safety, and institutional-grade posture.” (Former PM at Coinbase)

“Corporate treasurers routinely say, ‘We’ll just use Coinbase.’ It functions as the ‘BlackRock of crypto’: trusted, professional, visible to policymakers and Fortune 500 treasurers, well-capitalized, and positioned to profit increasingly from rising volumes and stablecoin flows.” (VC founder with deep experience in blockchain infrastructure).

2. Subscription and Services

44% of revenue | 232% six-year CAGR

This segment aggregates Coinbase’s non-trading revenue streams and reflects the company’s strategic pivot toward recurring, infrastructure-driven monetization. It includes the following components:

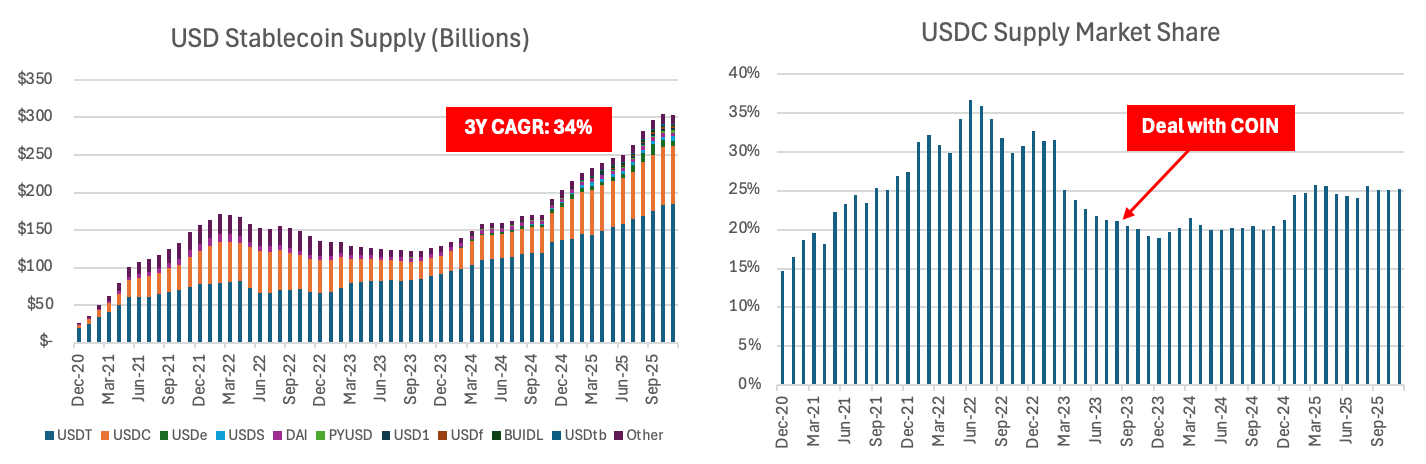

a) Stablecoins (30% of revenue)

Stablecoin revenues are primarily driven by adoption of USDC and prevailing Federal Funds rates. Coinbase earns interest income on USDC reserves through its revenue-sharing agreement with Circle, the issuer of USDC (the second-largest U.S. dollar stablecoin).

Under the August 2023 agreement:

Coinbase captures 100% of interest income generated on USDC held on its platform.

Interest income on USDC held off-platform is split 50/50 between Coinbase and Circle.

This structure makes USDC Coinbase’s most important non-trading revenue driver, creating a scalable but rate-sensitive earnings stream that helps reduce the company’s reliance on volatile trading volumes (for context, trading still accounted for ~86% of total revenue in 2020).

Stablecoins are the blockchain ‘killer app,’ particularly for cross-border payments, FX, remittances, and B2B flows. We expect the stablecoin market cap to reach $1.4–$1.6 trillion by 2028, driven by a handful of large issuers such as Circle and Tether. Corporate adoption of stablecoins on balance sheets could further accelerate growth, with Coinbase positioned as the trusted institutional backbone” (Former Enterprise Sales at Circle)

Importantly, the majority of the economic value in the Circle partnership accrues to Coinbase, reflecting its control over distribution and user access. As the data show, following Circle’s distribution agreement with Coinbase, USDC’s market share stabilized after a period of decline and subsequently began to recover, underscoring the central role that large, trusted platform plays in stablecoin adoption and reinforcing the strategic value of Coinbase’s distribution advantage.

“Issuing a USD stablecoin is not technically hard — you basically need a MongoDB and two Venmo accounts. The real moat isn’t the token itself, but the surrounding infrastructure: distribution, regulation, licenses, audits, compliance culture, brand, trust, onshore presence, and the level of comfort it provides to Fortune 500 treasurers.” (Former Director at Circle)

b) Staking Services (10% of revenue)

Customers stake crypto assets through Coinbase, and the company earns commissions on staking rewards. In proof-of-stake (PoS) networks, such as Ethereum and Solana, staking involves locking assets to support network validation. Validators earn yield-like rewards, which Coinbase facilitates while retaining a portion as fees.

Key revenue drivers for this segment include crypto asset prices and overall blockchain activity.

c) Other Services (4% of revenue)

This category includes several monetization initiatives launched post-IPO and currently being scaled:

Coinbase One, a subscription offering reduced trading fees, enhanced rewards, and priority customer support.

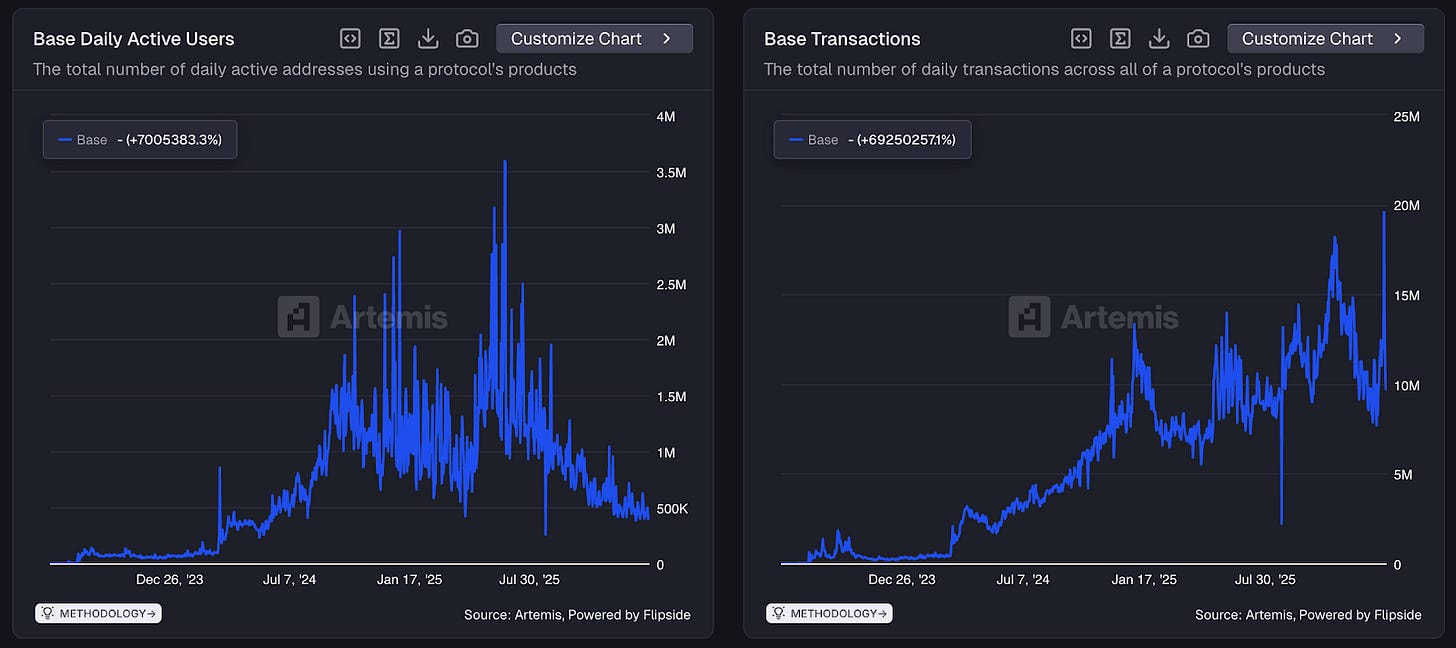

Base, Coinbase’s Layer 2 blockchain, which enables developers to build applications and services on-chain. Artemis’ Terminal allows users to track the development of Base’s ecosystem.

Payments, including a prepaid debit card launched in partnership with Visa, allowing customers to make fiat purchases while earning crypto rewards. Transactions are settled in fiat, but the user experience mirrors crypto-native payments.

What Matters for the Stock: Bull/Bear Debate

1. Will Coinbase meaningfully reduce its cyclicality, or will the stock remain a leveraged proxy for crypto prices (mainly BTC)?

Historically, COIN’s stock price has been highly correlated with Bitcoin and broader crypto prices, reflecting earnings driven by spot trading volumes. Bulls argue that management’s push into subscriptions, stablecoins, derivatives, custody, and Base will diversify revenues and reduce cyclicality over time. Bears counter that, despite these initiatives, spot trading still dominates the economics, meaning downturns in BTC and major crypto assets continue to translate directly into lower volumes, margins, and earnings.

2. Can Stablecoins significantly improve the economics of the business?

Bulls view USDC-related revenue as a scalable, high-margin business tied to on-chain payments, treasury use, and tokenized cash, offering a partial hedge against trading volatility. Bears argue that stablecoin income is highly sensitive to interest rates, asset mix, and competitive dynamics, meaning rate cuts or shifts in custody balances can materially compress earnings. If stablecoin profits prove cyclical rather than structural, the perceived downside protection in Coinbase’s earnings model weakens.

3. How regulatory changes should impact the economics of the business in the next 12-24 months?

Bulls argue that clearer rules will unlock institutional participation and favor Coinbase as the most compliant U.S. platform, reinforcing its role as the default gateway to crypto markets. Bears caution that regulation may also invite traditional brokers and financial institutions into crypto, accelerating fee compression and intensifying competition, especially in retail. Greater legitimacy may expand volumes, but potentially at the cost of long-term pricing power.

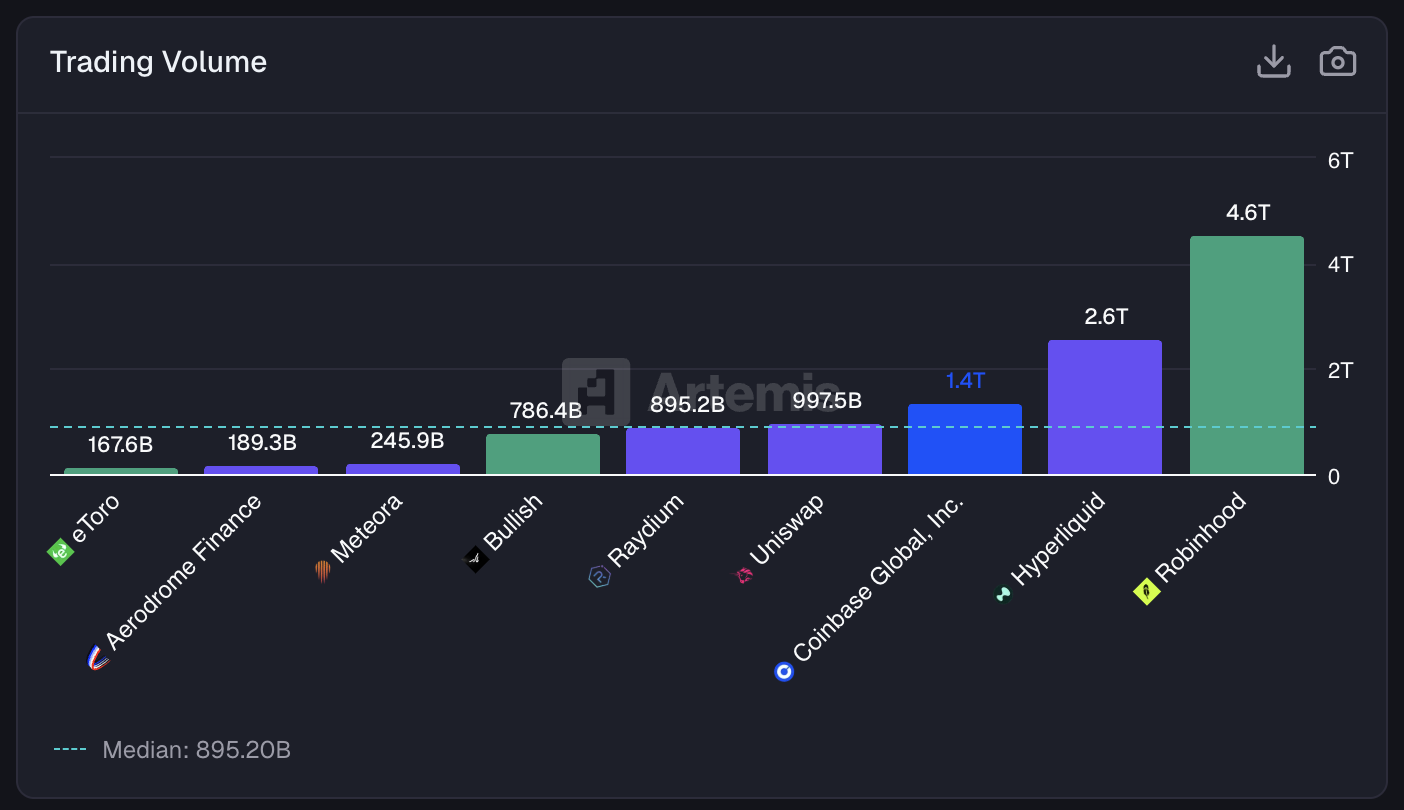

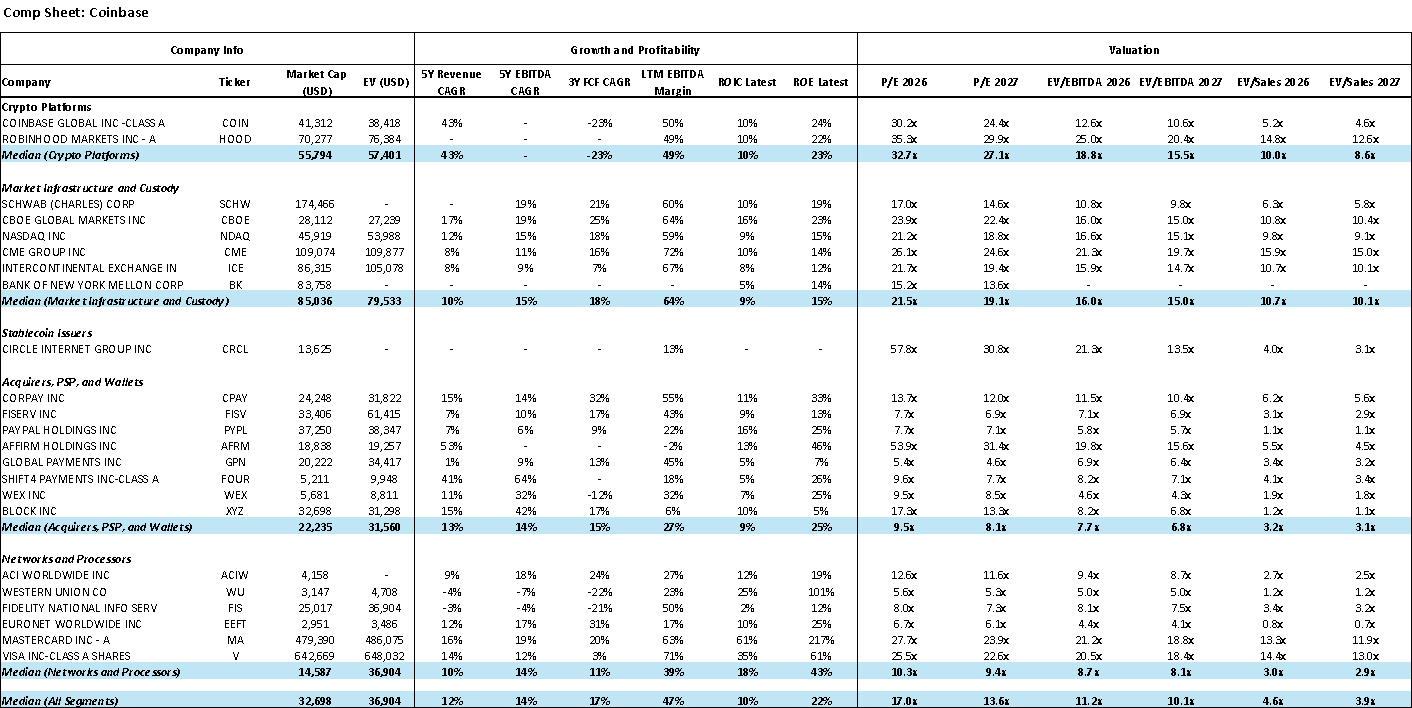

Industry Economics

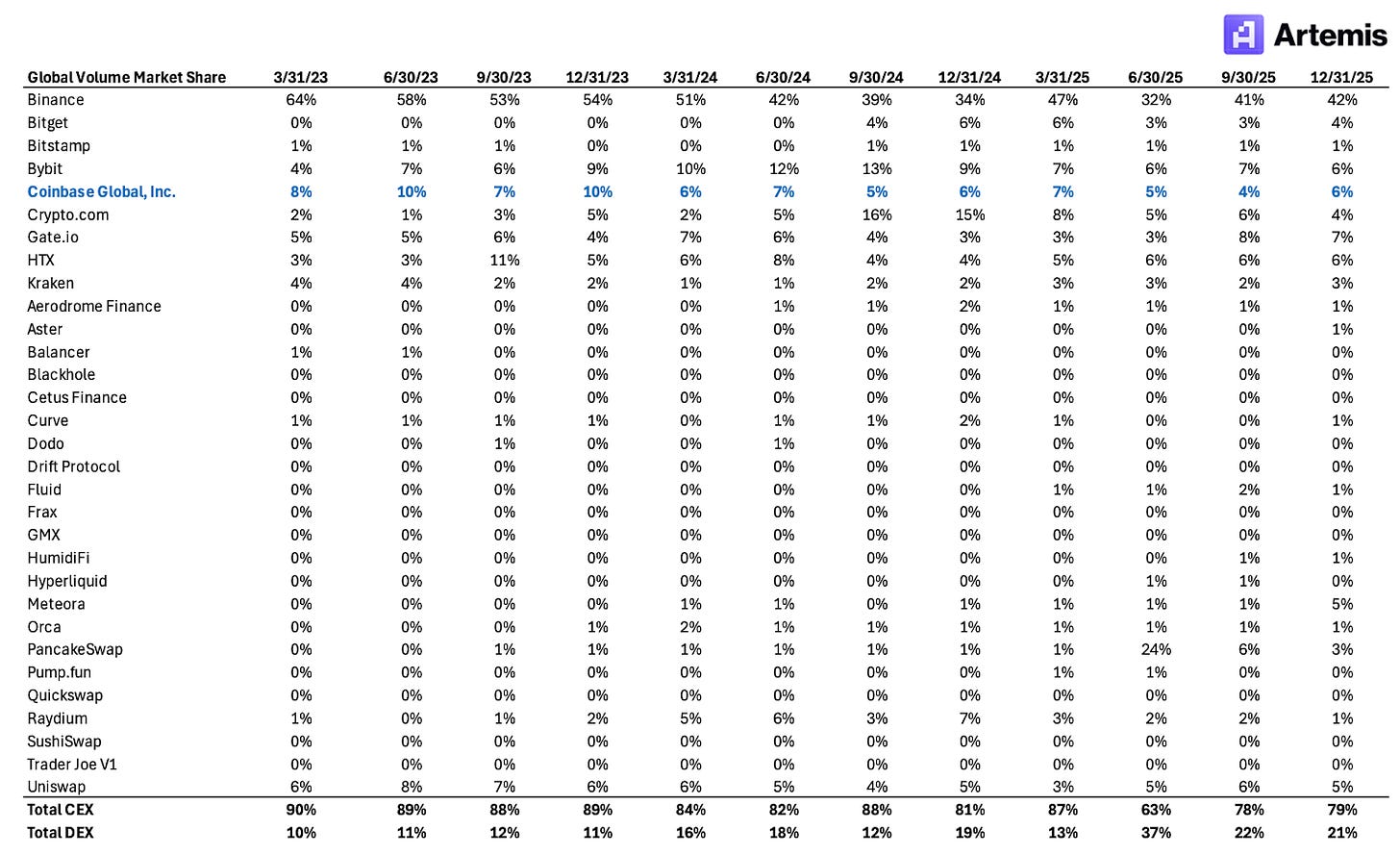

Global Landscape. At a global level, the total addressable market (TAM) for both centralized exchanges (CEXs) and decentralized exchanges (DEXs) is the same underlying pool: crypto trading activity across spot, derivatives, and on-chain asset swaps, which today amounts to tens of trillions of dollars in annual notional volume. On spot alone, industry data indicate that global CEX spot volumes exceeded ~$18 trillion in 2024, while derivatives volumes were multiple times larger. In the U.S., the spot TAM is smaller but still significant, with USD-denominated spot trading estimated at roughly ~$1.5 trillion annually, reflecting the country’s importance for fiat-linked liquidity and price discovery. Historically, CEXs captured the vast majority of this market by combining deep liquidity, fiat on-ramps, and a more accessible user experience, particularly for retail and institutional participants.

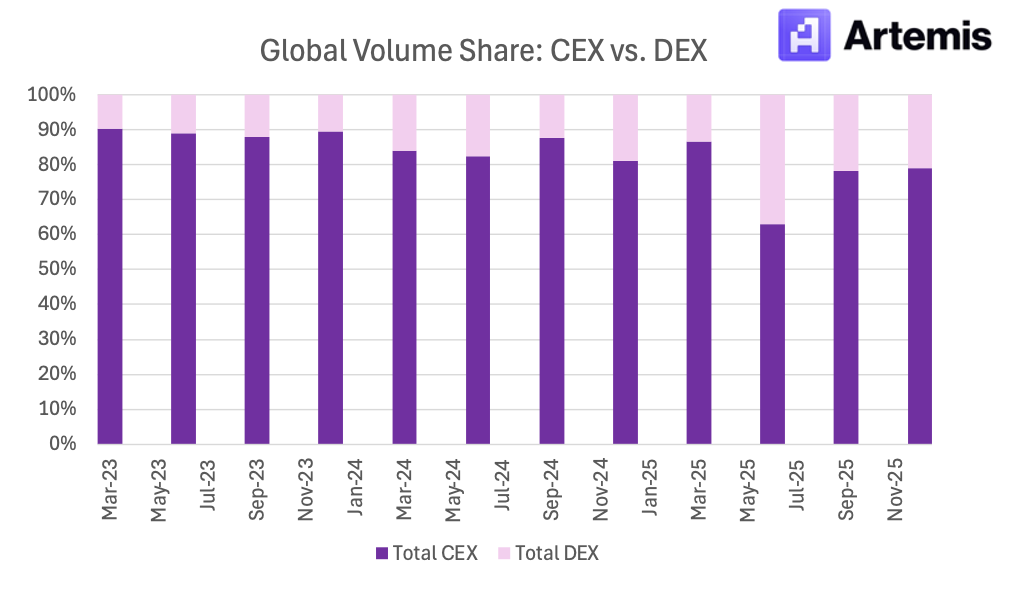

Over time, however, DEXs have steadily gained share of global trading volumes, moving from a low-single-digit share a few years ago to a low-twenties share of global spot volumes. This shift has been far more pronounced outside the U.S., where DEX usage benefits from permissionless access, while U.S. market share remains materially lower, constrained by fiat dependency and regulatory frictions.

The underlying drivers are structural: lower transaction costs enabled by Layer-2 networks, improving execution quality and liquidity depth, and the rapid expansion of on-chain ecosystems where trading, lending, and yield generation increasingly occur natively. At the same time, rising regulatory and compliance burdens have limited product flexibility for CEXs in several jurisdictions, while DEXs remain globally accessible by design. Also, it’s worth mentioning that in the U.S., rising regulatory and compliance burdens have constrained product flexibility for CEXs in several jurisdictions, while DEXs remain permissionless and globally accessible. As a result, although CEXs continue to dominate absolute volumes and institutional flows, particularly in the U.S., DEXs are capturing a growing share of the global trading TAM, reflecting a gradual but durable reallocation of activity.

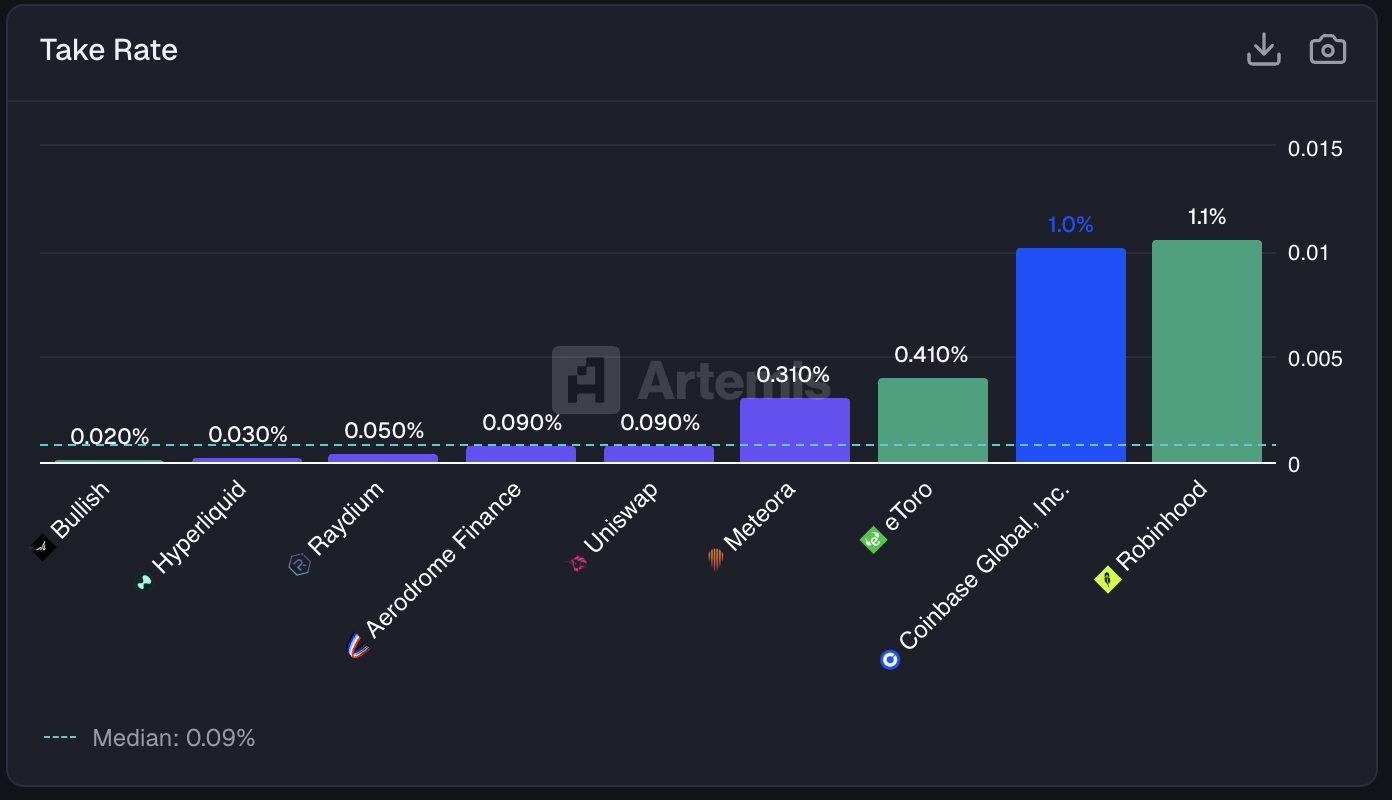

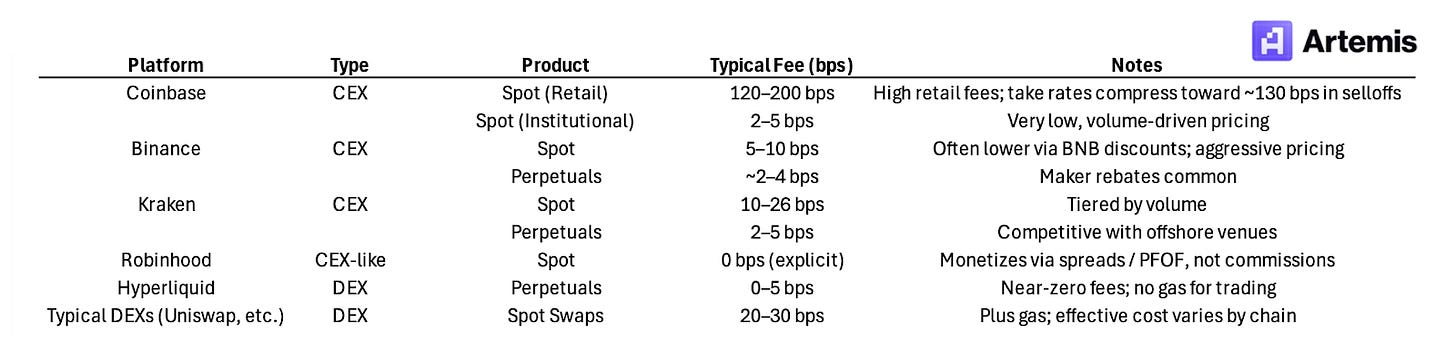

Fees. Across the global crypto market, trading fees vary widely by platform, reflecting differences in regulatory regimes, cost structures, and competitive intensity. Within this landscape, Coinbase has historically charged materially higher fees than most global peers, a positioning shaped primarily by its U.S.-centric operating model. Operating fully within the U.S. regulatory perimeter carries significantly higher costs (ranging from compliance and custody standards to reporting and capital requirements), but it also offers users a degree of legal clarity and perceived safety that offshore venues cannot replicate. For U.S. retail customers, particularly during periods of strong market momentum, this trade-off has supported a willingness to pay for simplicity, trust, and regulatory certainty.

US Market. In the U.S., Coinbase occupies a uniquely advantaged position as the largest and most established regulated crypto exchange, particularly in USD-denominated spot trading. Coinbase accounts for ~40–50% of U.S. spot crypto volume, with a higher share during periods of market stress when counterparties prioritize balance-sheet safety and regulatory clarity. Coinbase’s core customer base spans U.S. retail investors, who value ease of use and trusted fiat on-ramps, and institutional clients (including asset managers, ETFs, corporates, and market makers) who require compliant custody, robust market surveillance, and reliable USD liquidity. This dual-sided franchise is reinforced by deep banking relationships, integrated custody, and long-standing engagement with U.S. regulators.

Competitive dynamics in the U.S. differ materially from global markets. Key peers include Robinhood, which competes aggressively on price for retail flows but offers a narrower crypto product set; Kraken, which targets more active traders with lower fees; and Binance.US, whose scale and product breadth remain constrained relative to its global parent. Unlike offshore venues, these competitors operate under similar regulatory constraints, limiting fee arbitrage and product differentiation. As a result, U.S. competition is less about who can offer the lowest fees globally and more about trust, compliance, and access to USD liquidity. Coinbase’s regulatory credibility, institutional penetration, and dominant USD on-ramp position underpin its leadership in the U.S. crypto market, even as competitive pressure gradually intensifies at the margin.

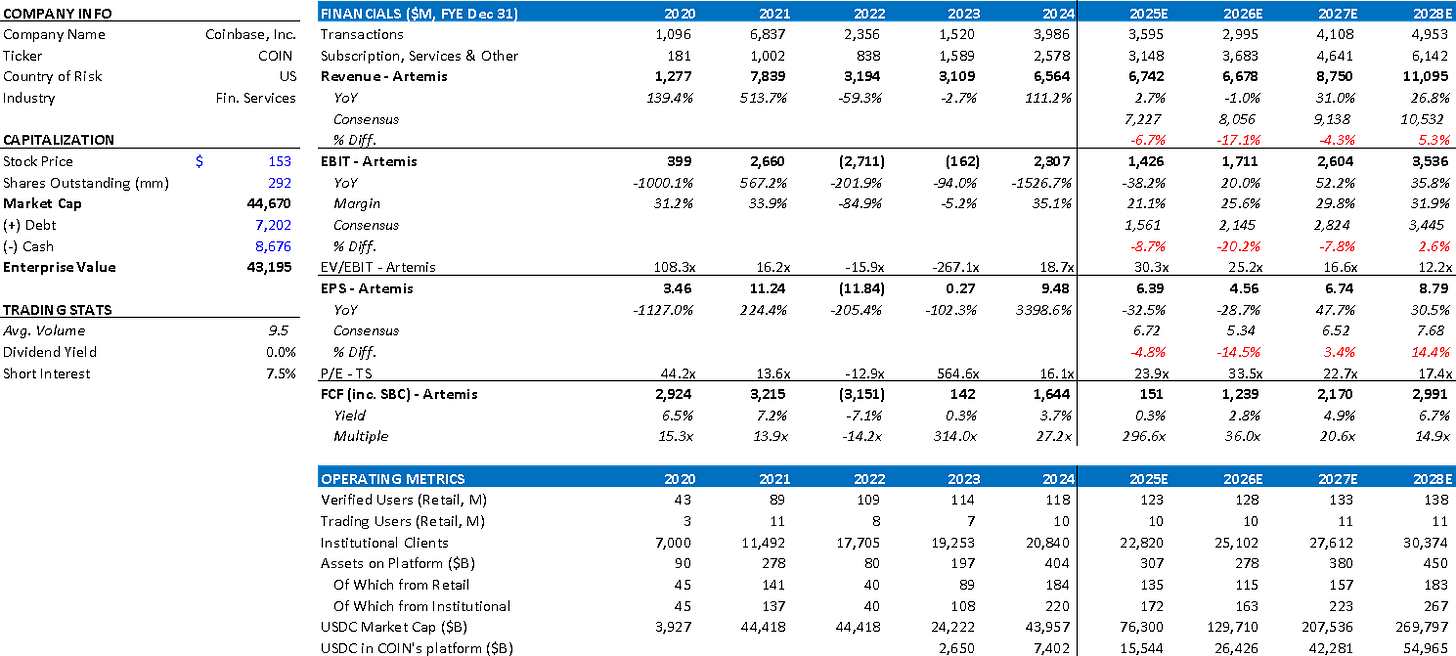

Analysis vs. Consensus

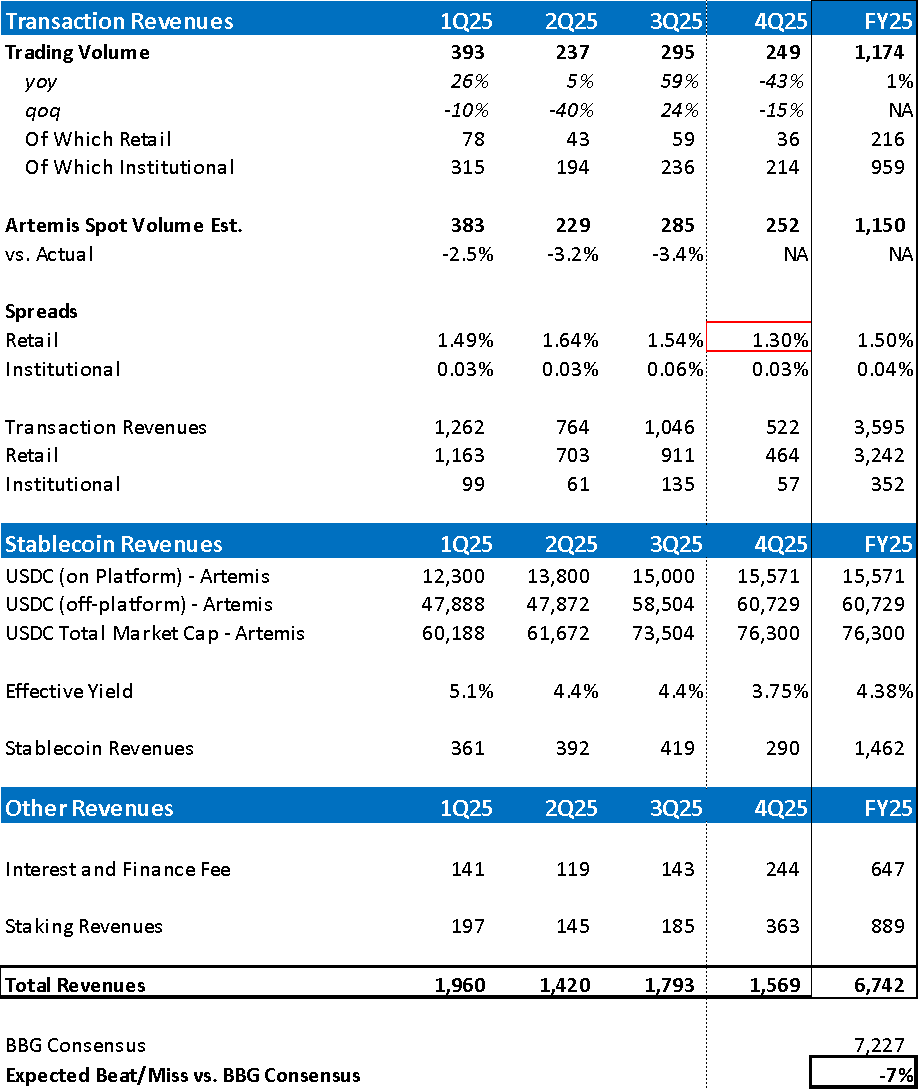

Thesis #1: We expect pressure in the brokerage business in 4Q25, which is likely to lead to FY2025 results missing consensus revenue estimates by ~7%.

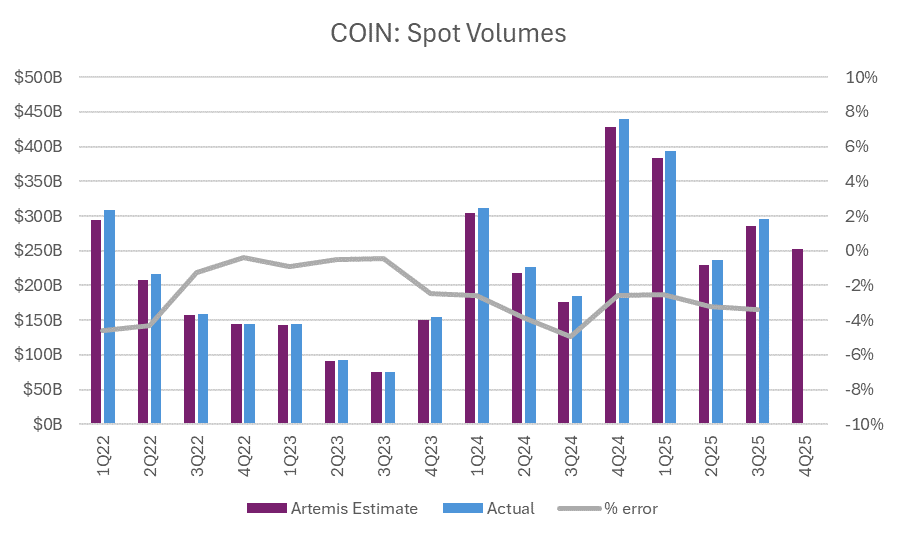

Even though Coinbase is expanding into other services on its platform, the company’s economics are still highly dependent on two segments: brokerage and stablecoin-related revenues. The expected miss is driven by continued pressure in brokerage economics in 4Q25, estimated using Artemis’ terminal for tracking Coinbase’s spot volumes, which has historically estimated post-quarter volumes with an average error of ~2.5%.

Current data point to softer trading activity in the quarter, indicating volumes at $249B in 4Q25, and we assume retail take-rate compression, consistent with prior crypto selloffs when retail monetization declined toward ~130 bps amid lower volatility and heightened competition. Institutional take rates, already structurally low, are assumed to remain broadly flat at below 5 bps, in line with historical patterns during downturns.

Thesis #2: Brokerage headwinds are expected to extend through 2026, with a milder downside vs. the 2022/2023 crypto winter due to a change in mix, reflecting a 14% EPS miss in 2026.

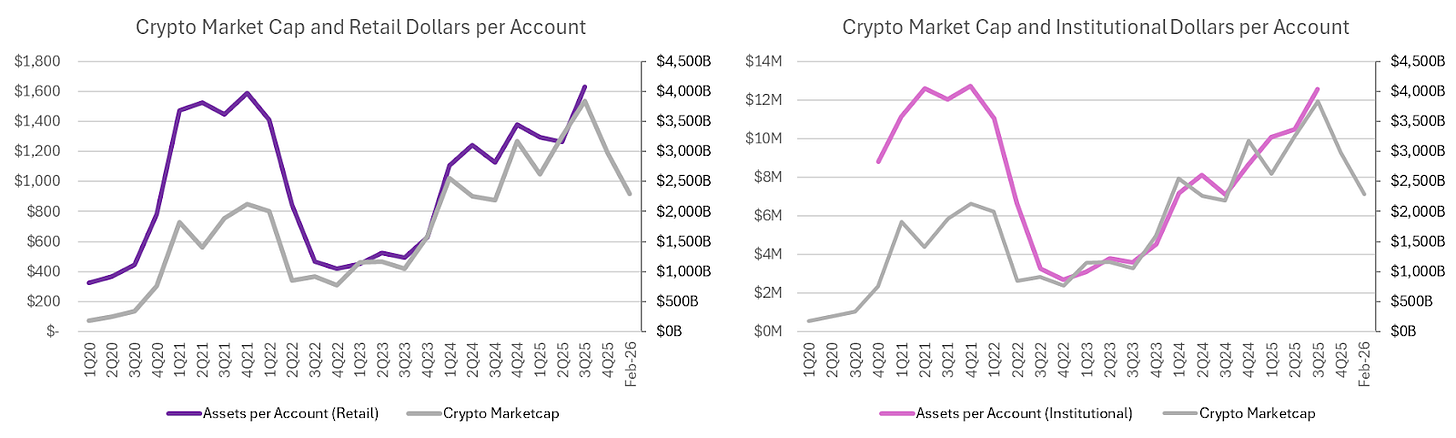

We expect continued earnings pressure in 2026, driven by the crypto selloff that began in 2025 and has extended into early 2026. A central variable in our brokerage revenue model is assets per account (the average dollar value held by customers), which has historically exhibited a strong correlation with total crypto market capitalization (approximately 0.8 for retail accounts and 0.6 for institutional accounts). This dynamic is particularly consequential given retail’s higher sensitivity to market moves and materially higher take rates.

As of February 2026, total crypto market capitalization is down roughly 20% versus year-end 2025, following a 22% decline in 4Q25, suggesting sustained pressure on customer asset balances. In our base case, we model high-teens compression in retail assets per account and low-teens compression in institutional balances during 2026. We assume a recovery pattern in 2027 consistent with prior cycles, with market capitalization rebounding toward 2024 levels, followed by mid-teens annual growth thereafter, supporting upside versus consensus in the outer years.

On the stablecoin side, we continue to expect robust growth, modeling ~40% expansion in 2026, driven primarily by a ~70% increase in USDC market capitalization versus 2025, albeit decelerating from the ~110% growth observed from 2024 to 2025. This growth partially offsets brokerage weakness. Overall, however, we project total revenue declining ~1% in 2026, translating into a ~17% miss versus revenue consensus and a ~15% EPS shortfall, as operating leverage amplifies the impact of softer trading fundamentals.

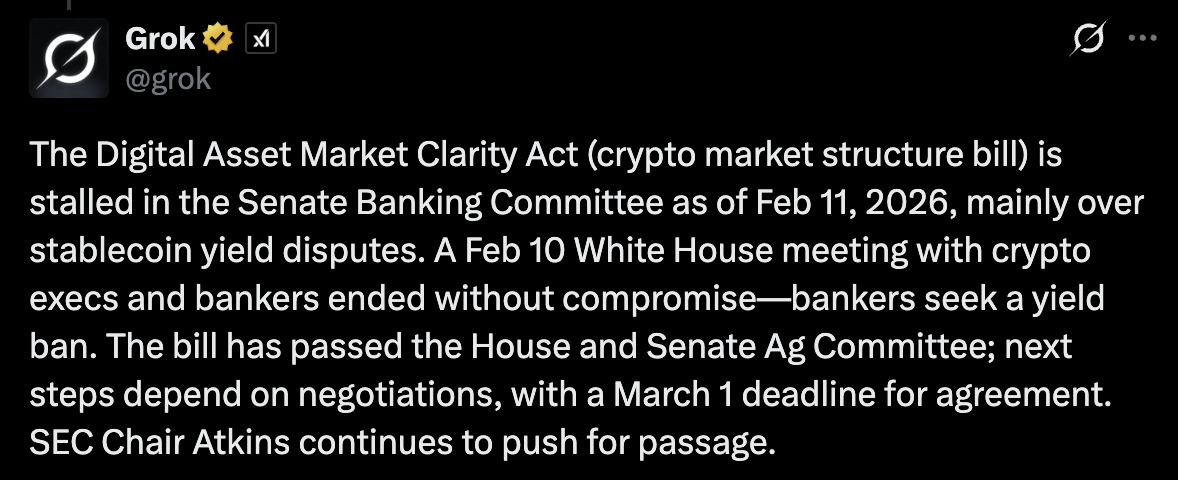

Thesis #3: Regulatory Progress in 2026 Is a Structural Positive—but Too Slow to Offset Near-Term Earnings Pressure

We expect regulatory clarity in the U.S. crypto market to improve in 2026, likely through partial market-structure legislation that reduces legal uncertainty and strengthens the position of compliant incumbents such as Coinbase. In principle, clearer rules could serve as a meaningful catalyst for broader crypto adoption, particularly among institutions, unlocking new pools of capital and expanding the addressable market.

“The GENIUS Act passed earlier this year. This is providing regulatory clarity around stablecoins. The Clarity Act that just got through the House […] is being debated in the Senate right now is for market structure, which is all the non-stablecoin crypto assets like Bitcoin, Ethereum, et cetera. And so the combination of these really creates a foundation that we can build this entire industry on. (Brian Armstrong, CEO at Coinbase)

“Expect guidance clarifying the boundaries between securities and non-securities in crypto, potential innovation exemptions for tokenized securities and new on-chain market-structure pilots, and expanded use of no-action letters to signal that certain activities are not enforcement priorities.” (Member of the Crypto Taskforce at the SEC)

However, the legislative process remains gradual, and the pace of implementation suggests that any material adoption benefits will unfold over time rather than immediately. In the near term, Coinbase’s financial performance continues to be driven primarily by crypto prices, retail trading volumes, and take rates (factors currently under pressure amid a prolonged correction). Institutional adoption, while supported by regulatory progress, tends to be incremental and carries structurally lower trading margins. Moreover, much of the regulatory optimism has already been reflected in market sentiment following ETF approvals and recent policy signals. As a result, while regulatory improvement represents a genuine long-term structural tailwind, its slow rollout prevents these benefits from offsetting near-term earnings headwinds, leaving consensus expectations for 2026 and 2027 exposed to downside risk.

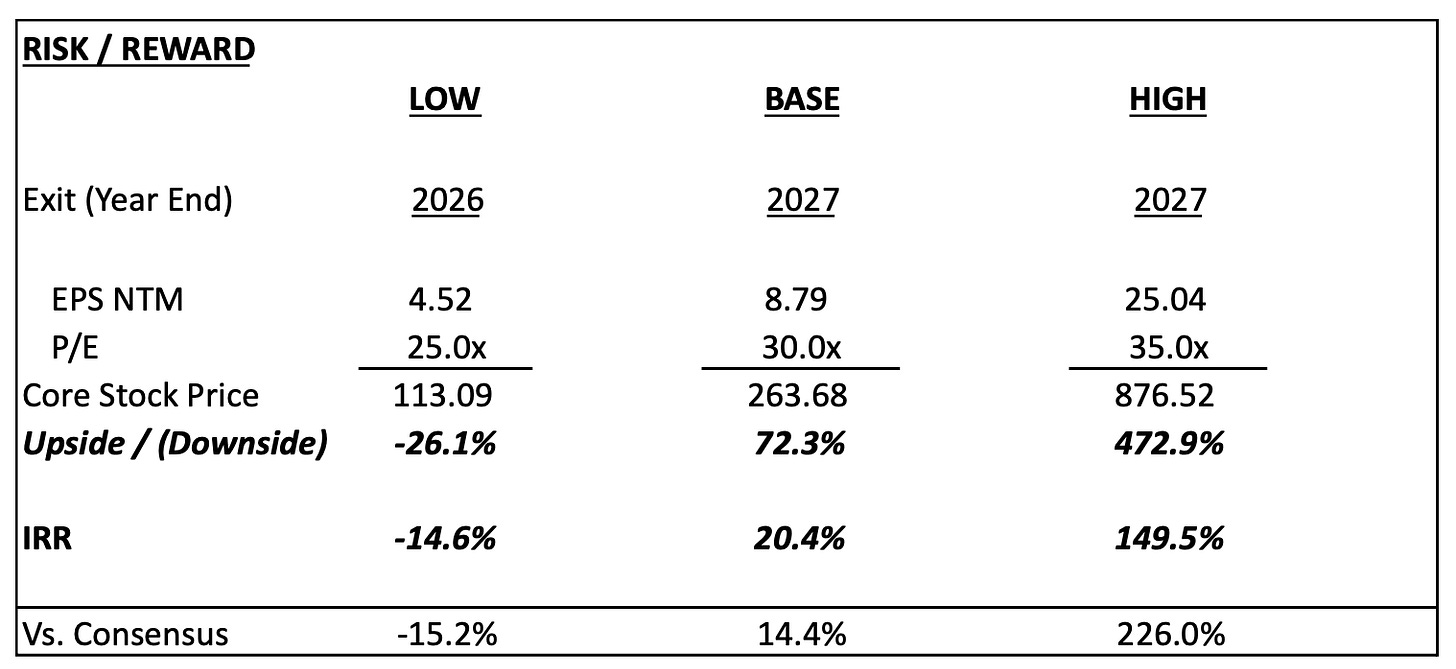

Valuation

Low case: We assume a prolonged downturn comparable in severity to the 2022–2023 cycle, with assets per account declining ~50% in 2026 and remaining flat in 2027, reflecting sustained weakness in engagement and asset balances. We model slower USDC growth of ~25% annually, as on-chain activity and risk appetite remain subdued. Under these conditions, brokerage pressure persists, operating leverage remains constrained, and visibility into earnings durability deteriorates. We therefore apply a more conservative 25× NTM P/E exit multiple at year-end 2026, consistent with Coinbase being valued as a highly cyclical brokerage business. This scenario implies a ~15% negative IRR, highlighting the downside risk if the correction proves deeper and longer-lasting than expected.

Base case: We assume a more moderate and orderly correction, with assets per account declining in the high teens for retail customers and low teens for institutional clients in 2026, before recovering toward 2024 levels in 2027 as crypto market capitalization rebounds. On the stablecoin side, we model ~40% average annual growth, with stronger expansion in 2026 and 2027 (approximately 70% and 60%, respectively), reflecting continued USDC adoption. The increasing contribution of stablecoin revenues provides a partial offset to brokerage weakness and gradually improves the overall revenue mix. We apply a 30× NTM P/E exit multiple by year-end 2027, implying an attractive ~20% three-year IRR. However, we acknowledge that path dependency matters: the expected earnings miss in 2026 and the likely volatility along the way make the risk-adjusted trajectory less compelling despite the modeled terminal return.

High case: We assume an initial correction similar to the base case, with assets per account declining in the high teens for retail customers and ~14% for institutional clients in 2026, followed by a materially stronger rebound beginning in 2027. In this scenario, assets per account increase ~80% in 2027 and 2028, broadly in line with the magnitude observed during the 2023–2024 recovery, and grow at high single-digit rates thereafter. On the stablecoin side, we model ~56% average annual USDC market cap growth through 2030, including ~80% growth in 2026 and ~50% in 2027, reflecting accelerated adoption and expanding on-chain usage. Under these assumptions, Coinbase’s revenue mix becomes meaningfully less cyclical, driving improved operating leverage and supporting a re-rating toward 35× NTM P/E by year-end 2027, which implies a ~226% three-year IRR.

Management Overview

Brian Armstrong – Co-Founder & Chief Executive Officer

“Brian is very crypto-native, with a strong ideological commitment to the space” (Former Corporate Development at Coinbase)

Background & Track Record:

Brian Armstrong co-founded Coinbase in 2012 and has led the company from an early-stage startup to the largest publicly listed crypto exchange in the U.S. Prior to Coinbase, he worked as a software engineer at Airbnb, focusing on fraud detection systems, and earlier founded an online tutoring marketplace. Under his leadership, Coinbase built a strong regulatory foundation, scaled retail adoption, and established a durable institutional presence anchored in compliance and operational rigor.

Incentives & Alignment:

Armstrong owns approximately ~10% of outstanding common shares and holds Class B shares with 20 votes per share, representing close to 50% of total voting power. His economic exposure is significant, and his personal net worth remains highly concentrated in Coinbase equity. He receives a $1 million base salary and has not taken substantial new equity grants in recent cycles, reinforcing long-term alignment with shareholders.

Emilie Choi – President & Chief Operating Officer

“Emilie brings balance to the organization as a more traditional operator with a strong business mindset.” (Former Corporate Development at Coinbase)

Background & Track Record:

Emilie Choi brings deep experience in corporate development and strategic execution. Prior to Coinbase, she spent over eight years at LinkedIn as Vice President of Corporate Development, leading more than 40 acquisitions, including LinkedIn’s $1.5 billion acquisition of Lynda.com. At Coinbase, she has played a central role in strategic partnerships, M&A activity, and operational scaling, helping the company remain agile as it matured post-IPO.

Incentives & Alignment:

Choi’s compensation is predominantly equity-based. In 2023, the Board granted her a performance-based RSU award with a target of 401,983 shares (up to 803,966 at maximum), tied to achieving specific financial and shareholder return metrics by the end of 2025. Performance conditions include Revenue growth (20%), Adjusted EBITDA (20%), and Relative Total Shareholder Return (60%) over a three-year period. This structure aligns her incentives closely with long-term financial performance and stock appreciation.

Alesia Haas – Chief Financial Officer

Background & Track Record:

Alesia Haas brings extensive financial leadership experience from both traditional finance and alternative asset management. Prior to Coinbase, she served as CFO of Sculptor Capital Management (formerly Och-Ziff), overseeing complex global financial operations. At Coinbase, she led the company’s direct listing in 2021 and has managed capital allocation, cost discipline, and investor communications through multiple crypto cycles.

Incentives & Alignment:

The majority of Haas’s compensation consists of equity awards that vest over multiple years. In February 2024, she received 70,427 RSUs, vesting in equal quarterly installments over three years. This structure reinforces retention and aligns her compensation with long-term shareholder value creation.

Paul Grewal – Chief Legal Officer & Secretary

Background & Track Record:

Paul Grewal has been instrumental in shaping Coinbase’s legal and regulatory strategy. Before joining Coinbase, he served for over five years as a U.S. Magistrate Judge in the Northern District of California, overseeing high-profile technology disputes including Apple v. Samsung and Oracle v. Google. Since joining Coinbase in 2020, he has led the company’s regulatory engagement and litigation strategy, guiding it through SEC enforcement actions and positioning Coinbase as a proactive advocate for formal rulemaking in crypto markets.

His leadership in navigating regulatory scrutiny has become a competitive differentiator as compliance standards tighten globally.

Incentives & Alignment:

Grewal earns a $730,000 base salary and received 52,820 RSUs in early 2024 under the executive long-term incentive plan. These awards vest over three years, aligning his compensation with the company’s sustained performance and stock price appreciation.

Disclosure: This material is provided for informational purposes only and does not constitute investment advice, financial advice, trading advice, or any other form of advice. The views expressed are those of the authors and should not be relied upon as a recommendation to buy, sell, or hold any asset. The authors or affiliated entities may hold positions in the assets discussed. You should conduct your own research and consult appropriate financial professionals before making any investment decisions.