Stablecoin Update: August 2025

Ethereum Adds $14bn in Supply; All Eyes on Hyperliquid; Stablecoin Funding Soars

Starting this month we’ll be sending out our monthly stablecoin update through Substack. You can download the full update here and each month we’ll send a quick overview with the most interesting trends we are seeing.

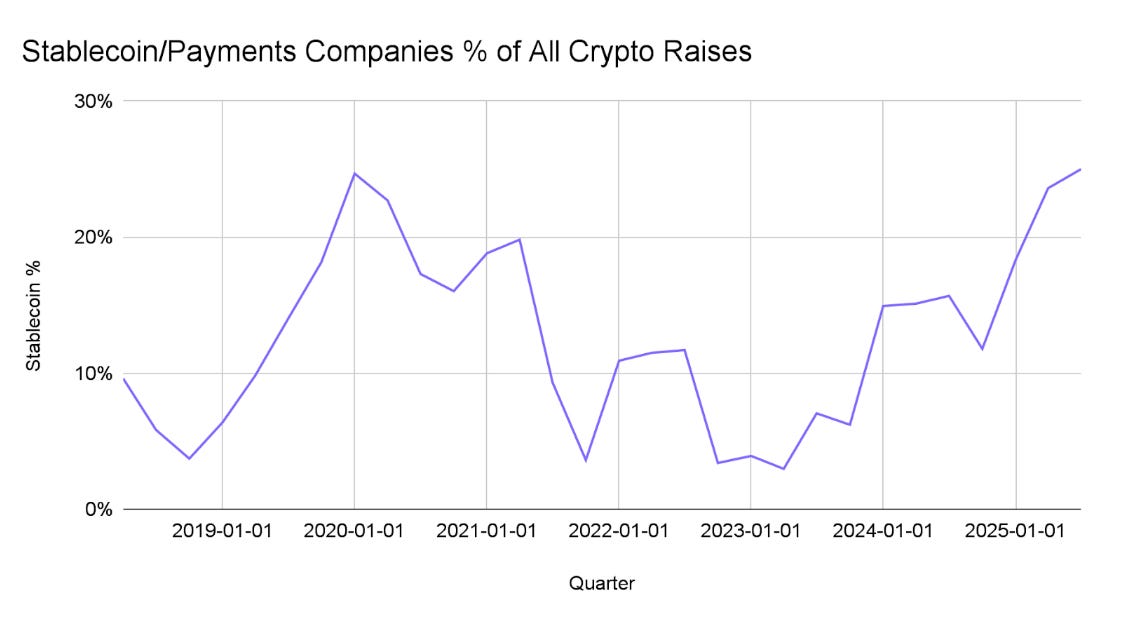

We believe stablecoins have become a critical piece of the crypto ecosystem. As new stablecoins emerge and companies like Circle go public, we believe stablecoins will become top of mind for all investors - regardless if they are in crypto or not. Stablecoins have become such a force that almost 25% of all money raised in crypto this quarter is for stablecoin related companies.

Source: Crypto-fundraising.info

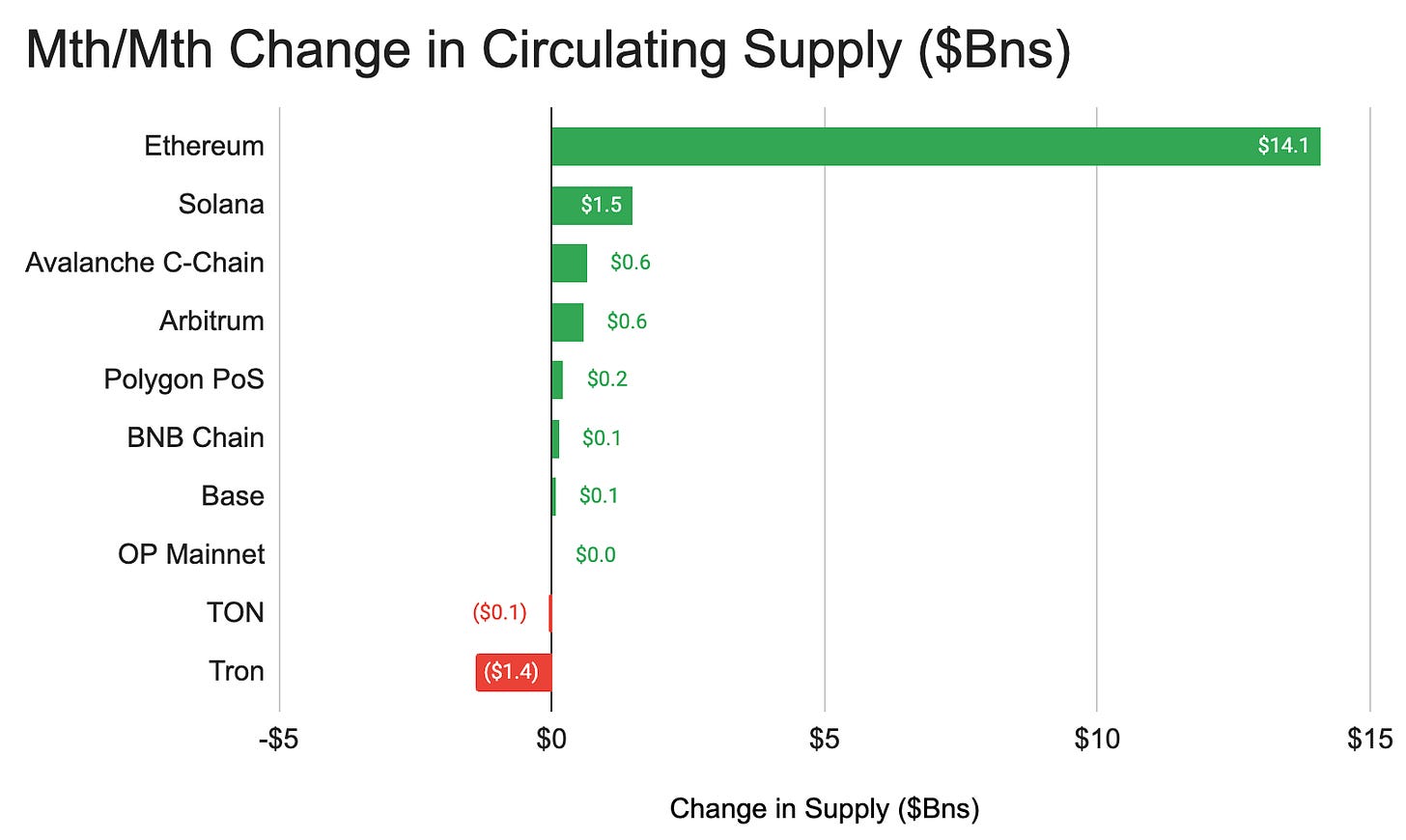

Ethereum Leads Chains with Massive Growth

The stablecoin supply continues to show astonishing growth and closes in on $300bn in supply. Last month saw an acceleration of supply with Ethereum gaining an astonishing $14bn in supply Month/Month.

Source: Artemis

What’s Driving the Growth - Almost Everything

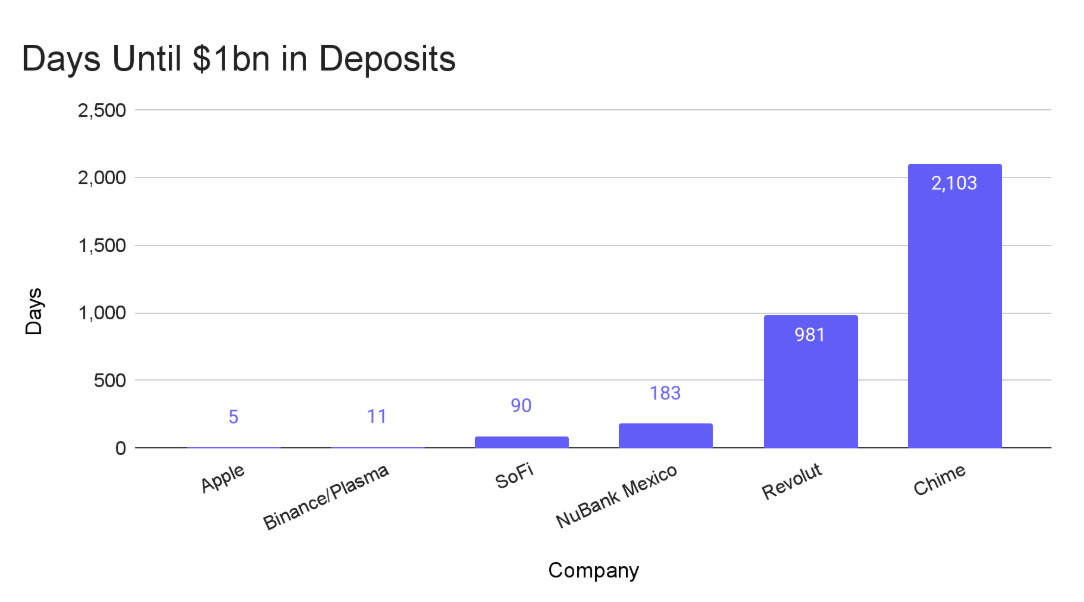

We continue to see a trend where stablecoin activity is growing in use cases and audiences. Binance/Plasma recently partnered to launch an “earn” campaign where users could deposit USDT to earn rewards. What amazed us was the speed in which users deposited money with the campaign. The campaign hit $1bn in deposits in less than two weeks. The size and speed of the deposit campaign outperformed traditional fintech companies, signalizing the widespread use of stablecoins and the brand power Binance/Plasma has.

Source: Artemis

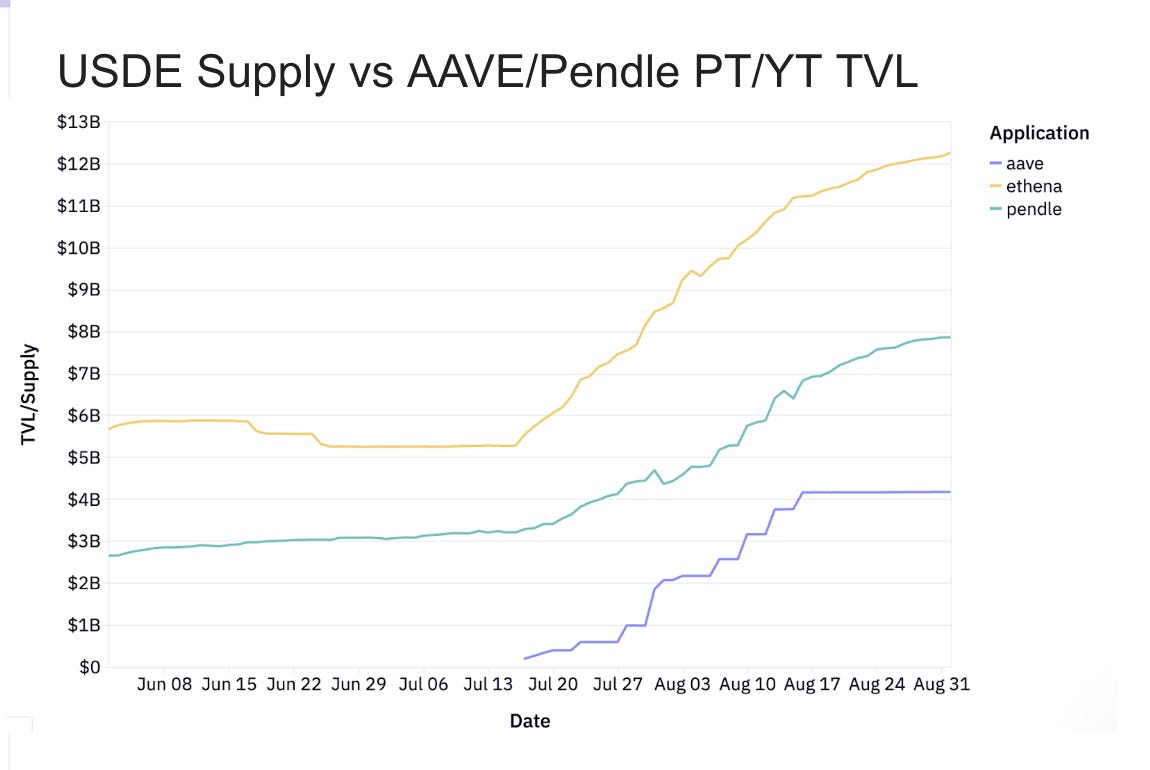

Stablecoin adoption is also increasing with more sophisticated DeFi users. When AAVE introduced Pendle PT/YT markets, Ethena USDe supply almost doubled in a month. Sophisticated users combine different protocols that serve as “Lego Blocks” allowing users to gain yield on stablecoins in innovative ways.

Source: Artemis

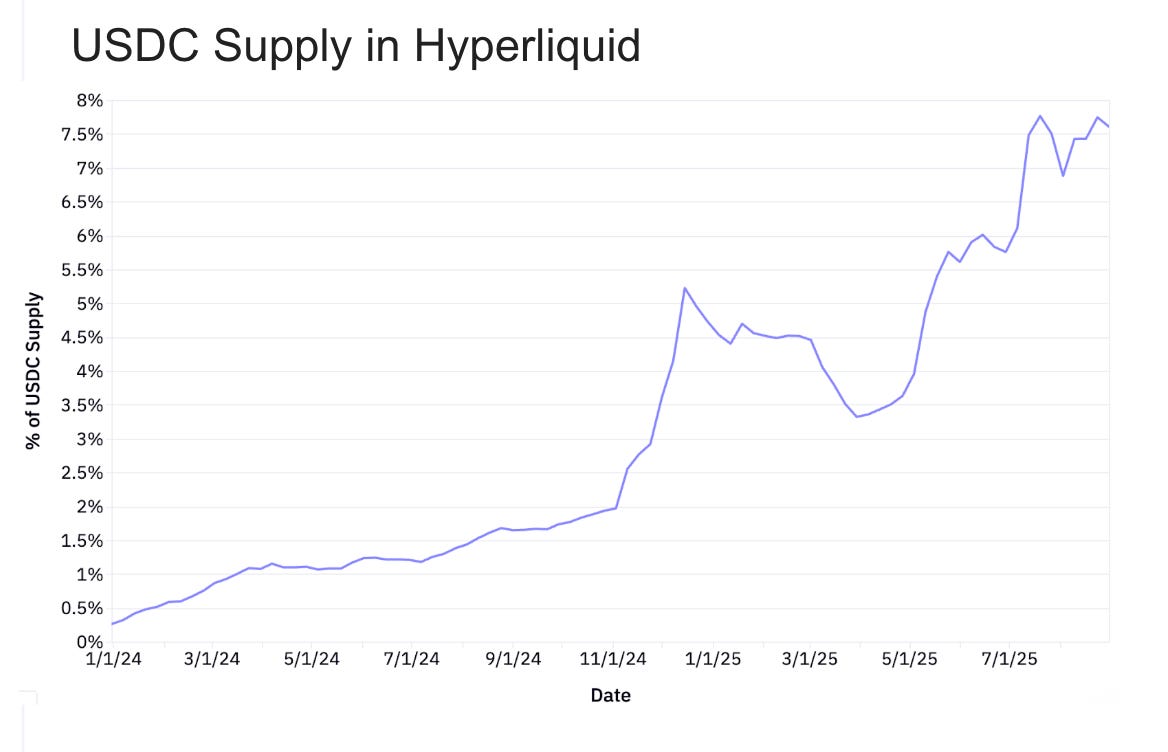

Hyperliquid Announces A Native Stablecoin

Last Friday via a Discord note, Hyperliquid announced they are seeking to launch USDH, a stablecoin native to the Hyperliquid ecosystem. The decision for Hyperliquid to launch a stablecoin is a potentially luractive one - and a potential headwind for Circle. Over the past year, Hyperliquid has served as a growth catalyst for the circulating supply of USDC and accounts for about 7% of USDC in circulation. At 4% interest, Hyperliquid stands to make an incremental ~$200mn a year if all USDC in the ecosystem was converted.

Source: Artemis

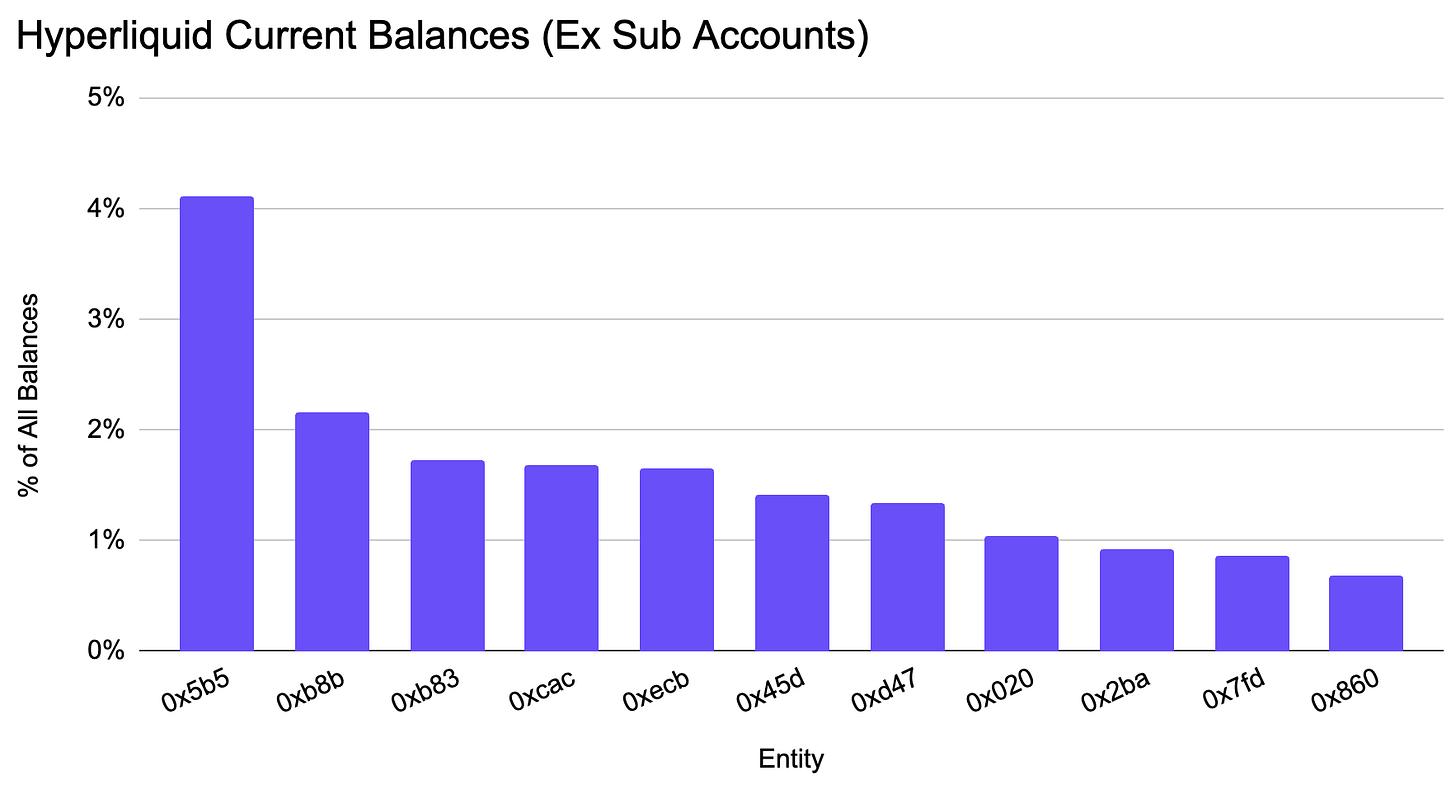

The conversion from USDC to USDH could take some time. The top 10 addresses only account for 17% of USDC on Hyperliquid indicating Hyperliquid has a lot of work to do to convert addresses.

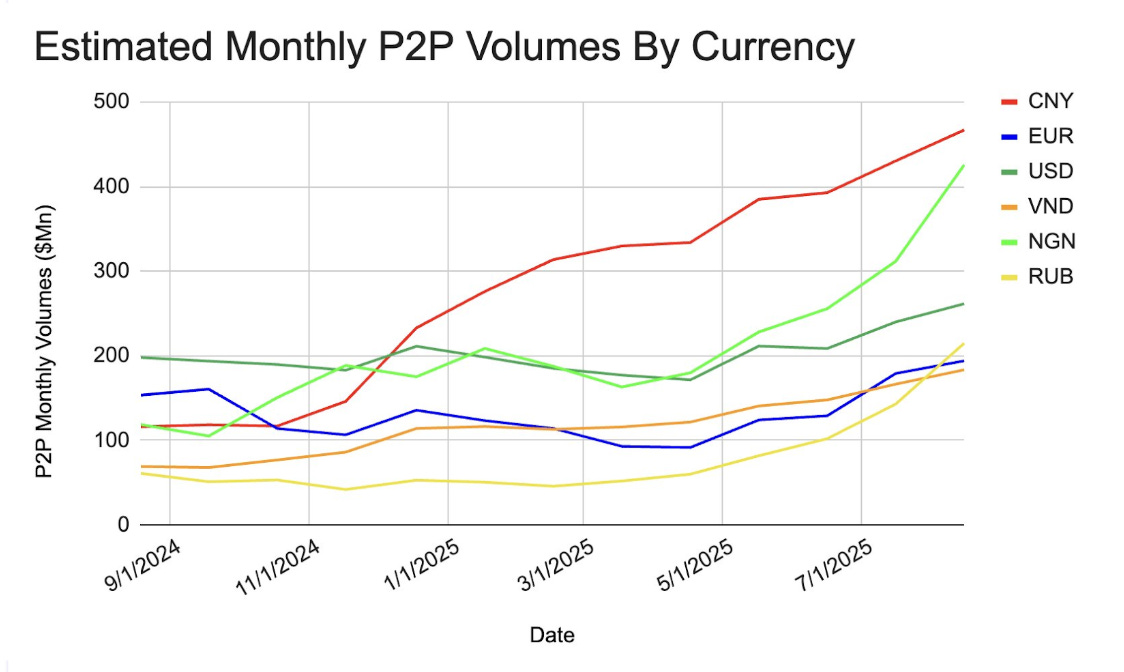

Stablecoins As the Global Currency

Finally, we see an increase in stablecoin usage across many non-USD markets. Using data from P2P Army + Artemis, we estimate Peer to Peer volumes on leading exchange apps. Nigeria is a country that stands out to us as the Naira is on pace to flip the CNY for P2P volume. Almost all countries have shown stablecoin p2p growth indicating stablecoins are becoming a “global currency.”

Source: P2P Army, Artemis

Here you can download the full update featuring even more insights and please don’t hesitate to reach out with any questions. We’ll also be attending plenty of conferences in all corners of the globe in the coming months and feel free to say hi!