Stablecoin September 2025 Update

Supply Over $300bn; Stablecoin Card Spend Explodes

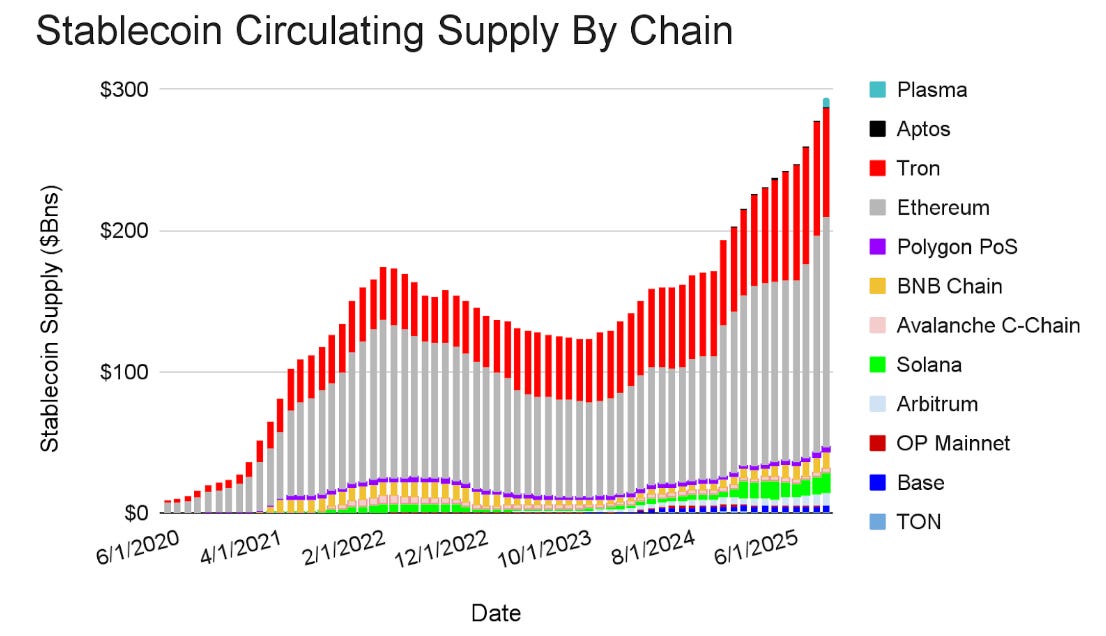

This past month saw another record for stablecoin supply (Here is the link to the full report )which now has a market cap above $300bn. Even with an extremely volatile market, stablecoin supply has shown consistent growth in the past month and continues to be decoupled from overall market trends. We continue to see novel use cases and opportunities, from card spend to “private credit” that stablecoins are assuming.

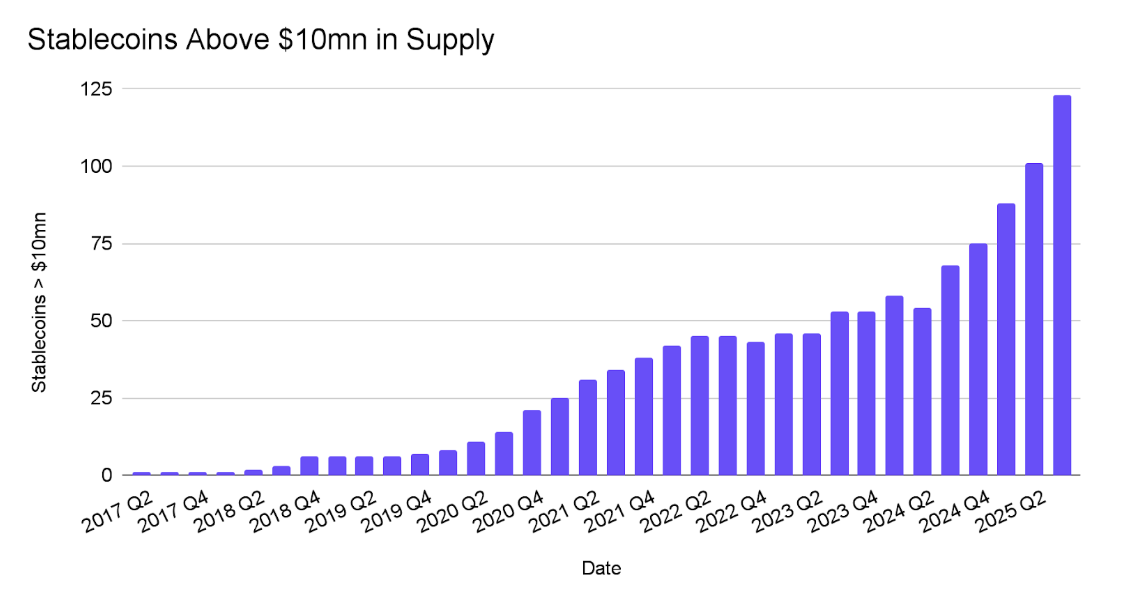

With all of the opportunity comes fierce competition. Month/Month growth of stablecoins over $10mn accelerated with 123 stablecoins up from 100 the previous month. It seems almost every entity is now exploring their own stablecoin solution as Metamask, Hyperliquid and Phantom have all launched a stablecoin in the past month.

Stablecoins Increase in Use Cases

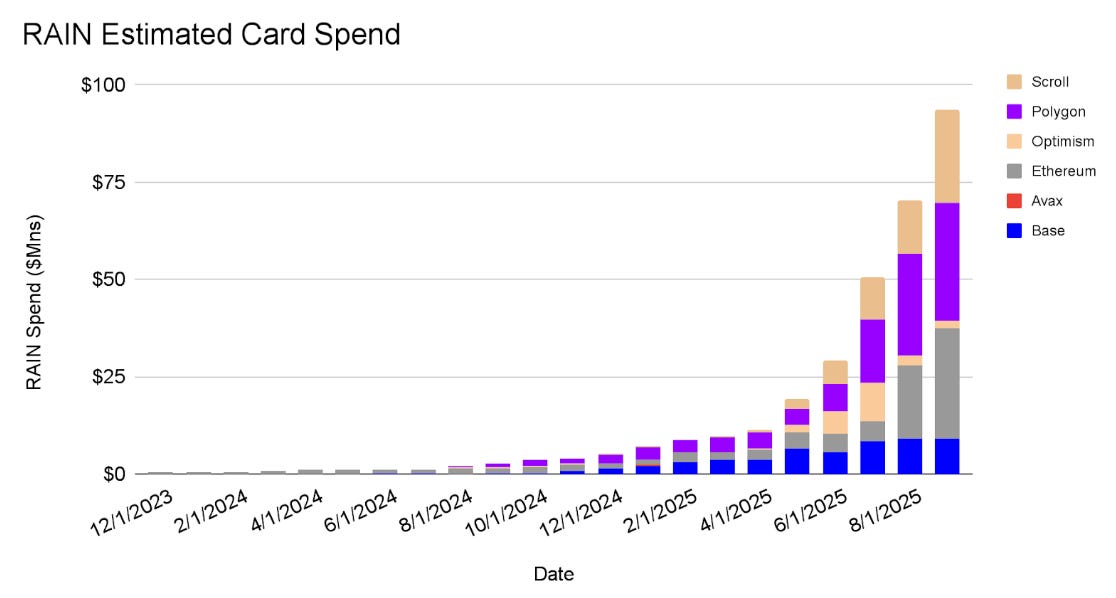

Stablecoins have moved past the “speculation” phase and are seeing a wide variety of uses cases. Spending of stablecoins via card rails has seen an absolute meteoric rise. RAIN, a company that recently raised $58mn in a series B round, had almost $100mn in stablecoin volume spend volume in September.

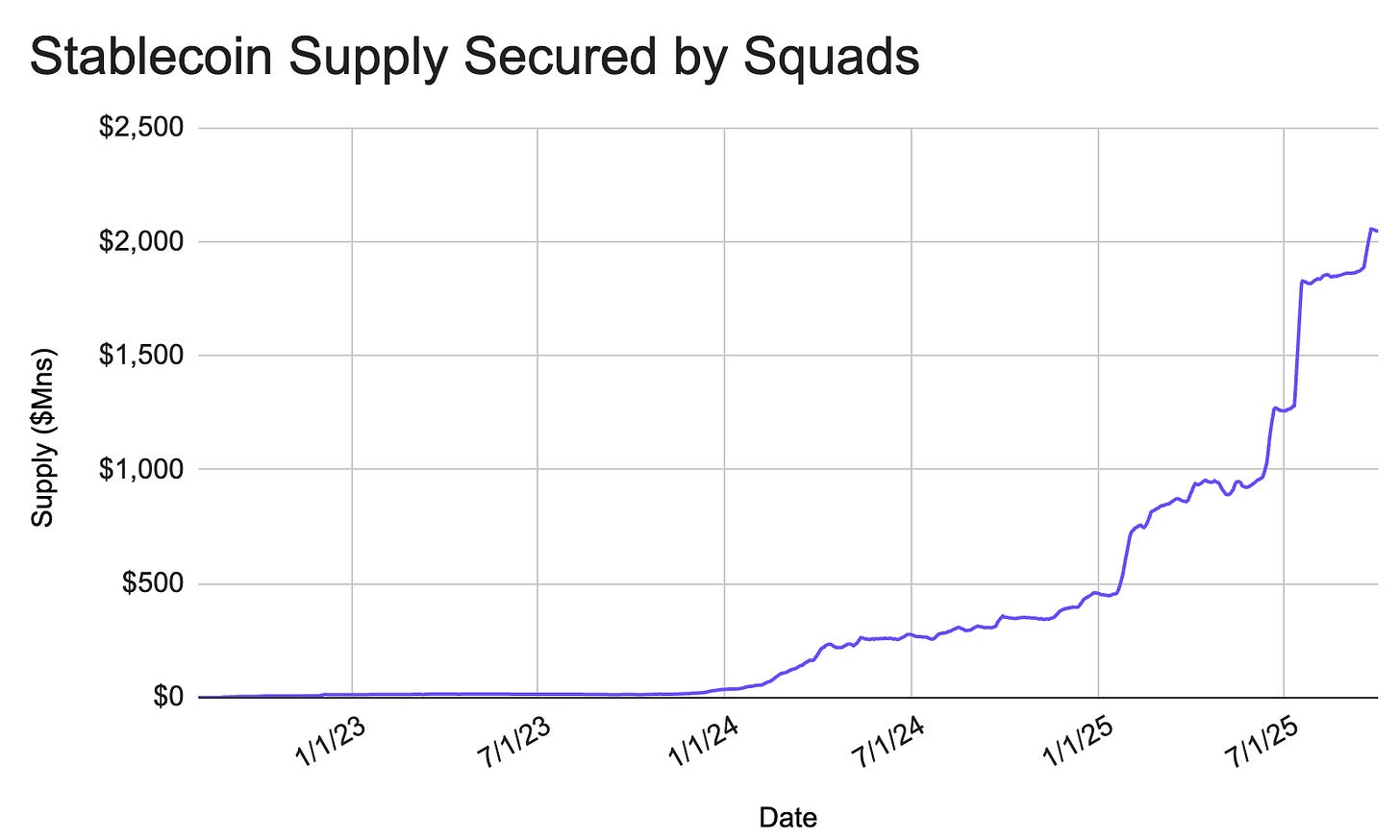

Full service solutions like Squads now dominate stablecoin supply on Solana. Squads recently passed the $2bn in secured amount and offers a wide range of solutions from Visa card to offering yield products to business accounts.

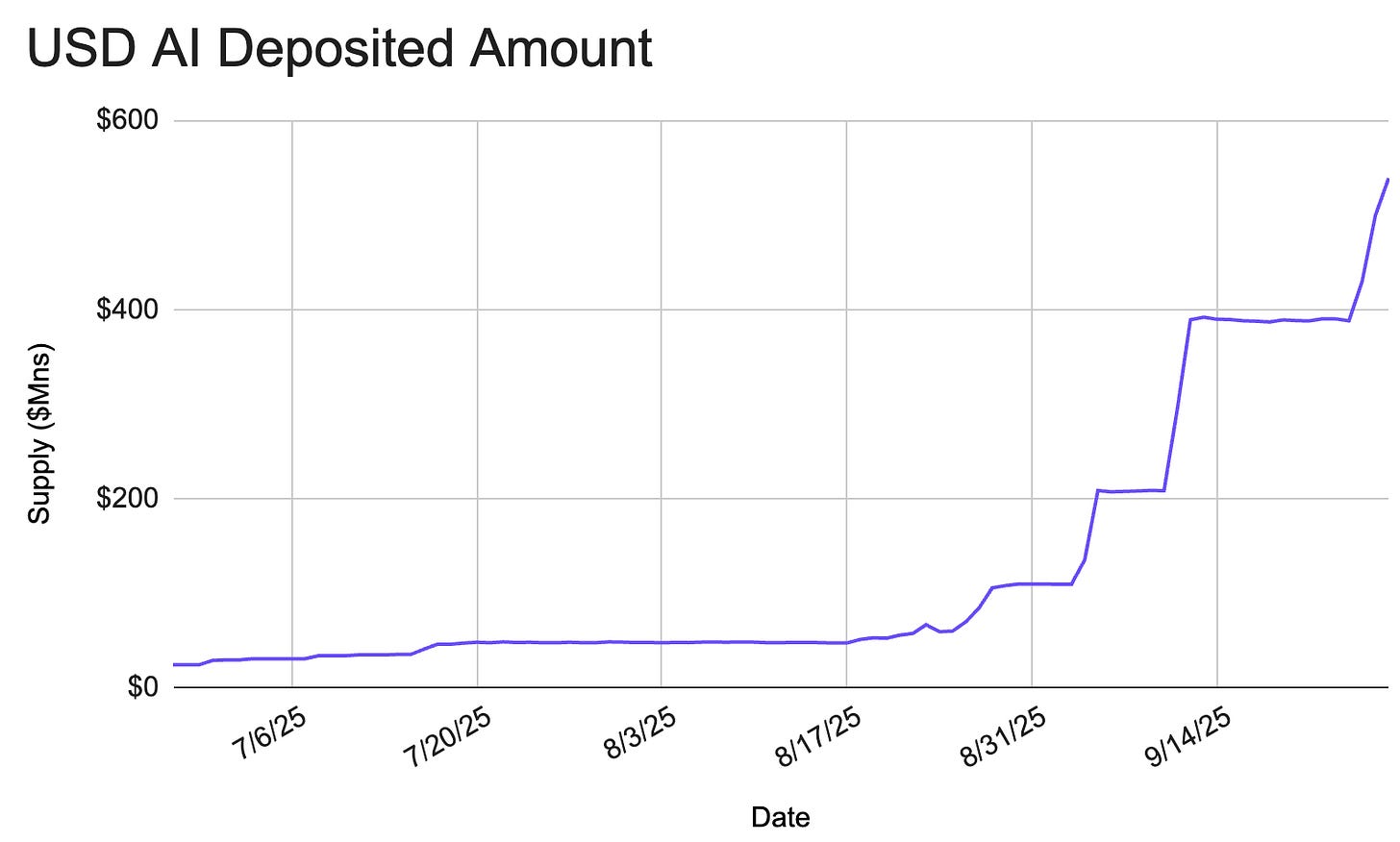

Stablecoin yield is also starting to evolve and mirror private credit like opportunities. Products like USD AI allow users to buy a stablecoin and get exposure to AI related financing. While stablecoins might just be the “wrapper” it’s worth noting the evolving nature of this market.

Here is the link to the full report with many more insights. Feel free to reach out with any questions.