Coinbase Q2'25 Spoiler Alert: How to Predict Coinbase Revenue.

Our analyst Kevin Li estimates Coinbase’s Q2 revenue at $1.495 billion which is -6.2% vs. the Street estimate of $1.594 billion, using publicly available blockchain data.

Update Post Earnings 7/31:

Estimate: $1.495 billion (-$2m)

Street: $1.594 billion (+97m)

Actual: $1.497 billion

Executive Summary:

Real-Time Revenue Forecasting with Onchain Data: Leveraging crypto’s inherent transparency, we estimate Coinbase’s Q2 revenue at $1.495 billion vs. the Street estimate of $1.594 billion, using publicly available blockchain data.

Trading Revenue Dominates Despite Market Decline: Estimated at $710 million, trading revenue remains Coinbase’s largest segment, with institutional and retail volumes down in Q2 following a meme rally cooldown.

Explosive Stablecoin Growth Powers Revenue: With USDC’s supply growing 36.7% to $60B, stablecoin revenue surged to an estimated $396 million, making it the second-largest revenue contributor.

Layer 2 & Interest Revenue Add Meaningful Lift: Base is projected to make $57.82 million, combining onchain fees and inferred non-fee income; blockchain rewards (mostly ETH staking) added $159 million; and interest income and subscriptions brought in $72 million and $117 million respectively.

One of the key advantages of crypto/blockchain is its transparency and that you can actually ESTIMATE in real-time revenue for blockchain adjacent businesses.

In traditional finance (TradFi), analysts cannot get an early previews of a company’s quarterly performance unless the company relates to consumer spend in which case there’s credit card panel data. In crypto, however, everything is onchain and publicly verifiable. This allows anyone to analyze blockchain data and form real-time forecasts of company fundamentals. In this article, we’ll walk through how onchain activity can be used to predict Coinbase’s revenue.

Coinbase’s revenue breaks down into several key segments:

Trading Revenue

Base Revenue

Blockchain Reward Revenue

Stablecoin Revenue

Other & Subscription Revenue

Interest Revenue

Trading Revenue:

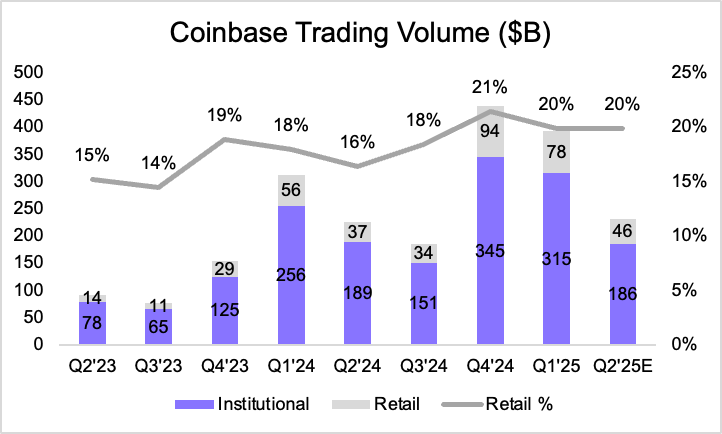

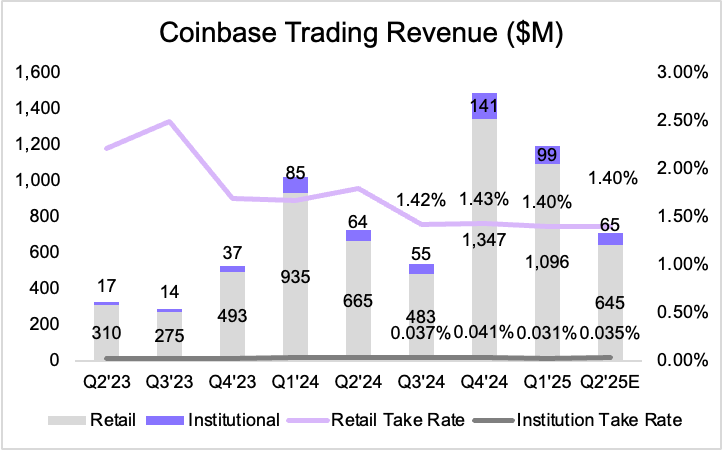

Coinbase’s trading activity is observable onchain, making it relatively straightforward to estimate trading-related revenue. In Q2, Coinbase recorded a total trading volume of $232 billion, a 41% decline from Q1. This pullback reflects a broader cooling in crypto markets, particularly after the meme-driven rally linked to the Trump election narrative lost steam. Volume faded especially in the second half of the quarter. Retail trading has consistently accounted for 18%–20% of total volume. For Q2, we use the upper bound of 20%.

Applying a 1.4% take rate to the retail segment, we estimate $645 million in retail revenue. For institutional clients, we assume a slight increase to 0.035% take rate, reflecting Coinbase’s derivative product offerings, yielding approximately $65 million. Together, total estimated trading revenue comes to $710 million.

Base Revenue:

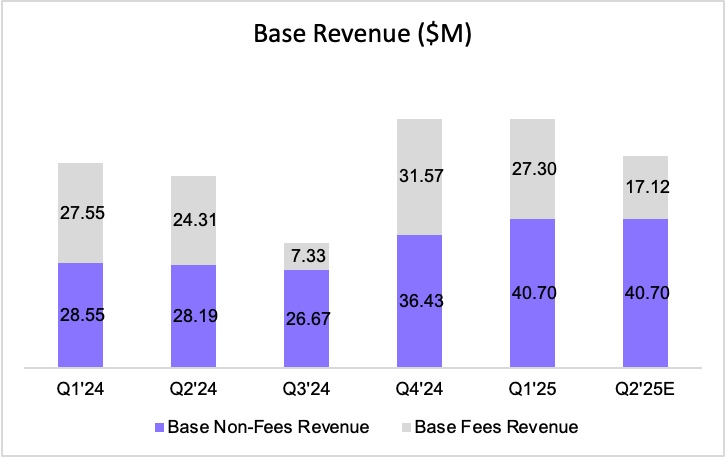

Base, Coinbase’s Layer 2 network, earns revenue through transaction fees and likely additional non-fee revenue sources. Onchain data allows us to directly track fee income, which we estimate at $17.12 million for Q2. However, Base’s reported revenue has consistently exceeded onchain fee totals, suggesting income from B2B partnerships or infrastructure support. Assuming non-fee revenue remains flat at $40.7 million (based on recent quarters), total Base revenue for Q2 is estimated at $57.82 million.

Blockchain Reward Revenue

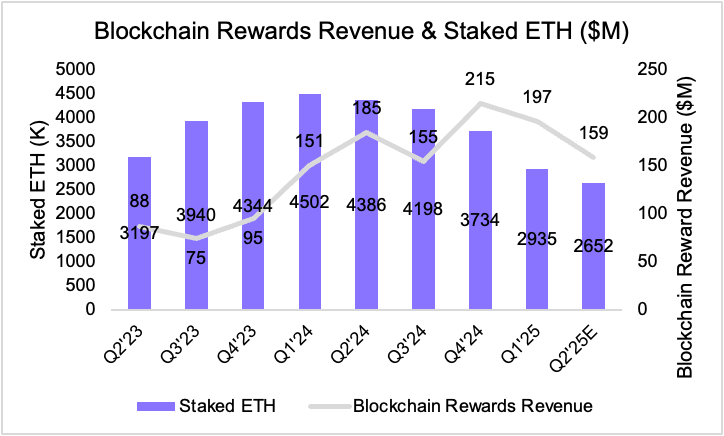

Coinbase provides staking services across several assets. For simplicity, we use staked ETH as a proxy to estimate blockchain reward revenue. Onchain data shows Coinbase’s staked ETH dropped from 2.935 million to 2.652 million over Q2, likely due to redemptions and staking rebalancing.

Based on this ETH range and average reward assumptions, we estimate $159 million in blockchain reward revenue. While approximate, this method captures the directional trend of this revenue stream.

Stablecoin Revenue

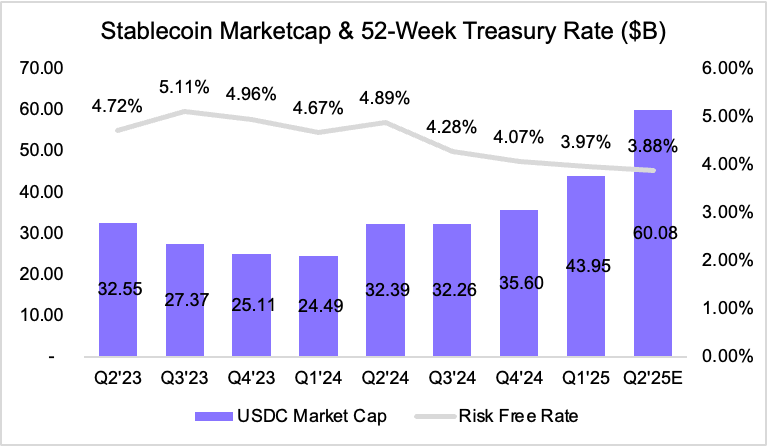

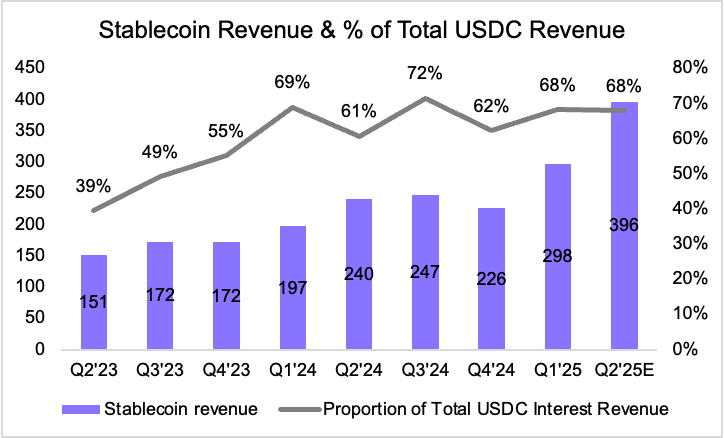

The stablecoin business—via USDC—was a major growth driver in Q2. USDC’s market cap surged to $60 billion, a 36.7% increase quarter-over-quarter. To estimate yield on reserves, we use the 52-week U.S. Treasury rate, which dipped slightly from 3.97% to 3.88%. Despite the rate drop, the jump in USDC supply more than offset it.

Coinbase’s share of total USDC revenue has fluctuated between 62% and 72% in recent quarters. Using the median of 68% as a baseline, we estimate $396 million in stablecoin-related revenue for Q2.

Other Subscription & Service Revenue

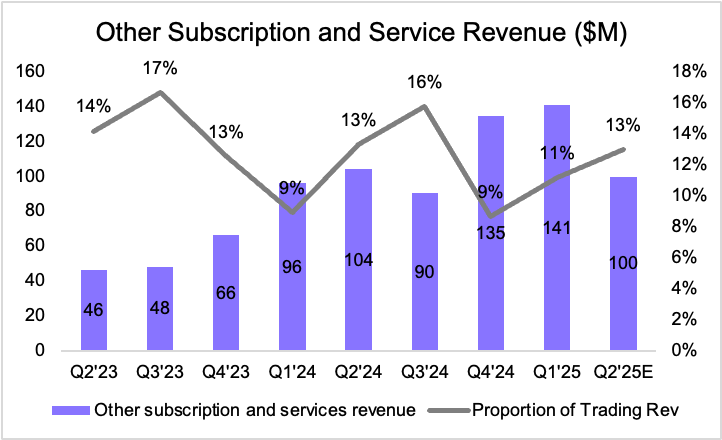

This segment includes revenue from Coinbase One (its premium subscription product) and custody fees—particularly for ETF clients. We view this revenue as a function of total trading activity. Applying a 13% multiplier to trading revenue, we estimate $100 million for Q2, marking a 29% decline quarter-over-quarter in line with lower overall trading volume.

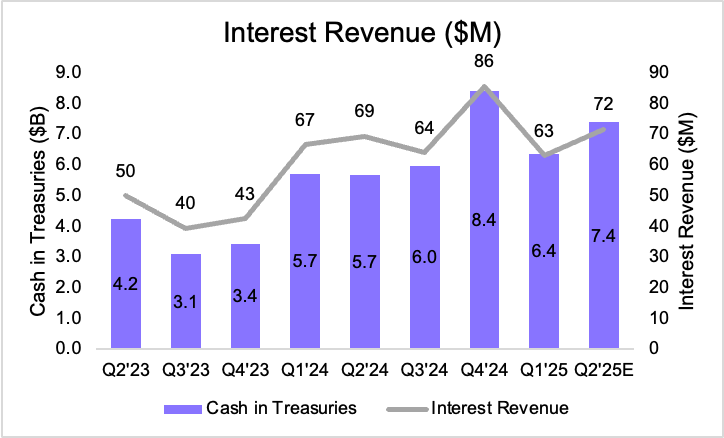

Interest Revenue

Lastly, Coinbase earns interest on its cash and treasury holdings. Using the same 52-week Treasury yield as a benchmark, we estimate $72 million in interest income for Q2. This represents a 12% increase from the previous quarter, primarily due to growth in Coinbase’s treasury position rather than a change in yield, which remained declined slightly

Conclusion: Putting It All Together

By leveraging onchain data, we can construct a detailed and timely estimate of Coinbase’s quarterly revenue—before official earnings are released. Summing across all key segments:

Trading Revenue: $710 million

Base Revenue: $57.82 million

Blockchain Reward Revenue: $159 million

Stablecoin Revenue: $396 million

Other Subscription & Services Revenue: $117 million

Interest Revenue: $72 million

This brings our total Q2 revenue estimate for Coinbase to $1.495 billion, compared to the Street estimate of $1.594 billion.

While some line items rely on proxies and assumptions, the overall model demonstrates the power of onchain transparency. With increasingly granular blockchain data, even non-insiders can now generate institutional-quality forecasts—an edge that was once exclusive to Wall Street analysts.

The authors of this content, as well as affiliates of Artemis Analytics, may have financial interests in the protocols or tokens mentioned. This does not constitute investment advice or a recommendation to buy, sell, or hold any asset. The information provided is for educational purposes only and should not be relied upon for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. Views expressed may change without notice, and Artemis Analytics is not liable for any losses resulting from the use of this content.

Turned out to be quite accurate. Next time publish such articles at least 1 day before the earnings release.

What address is for the trading activity?