Artemis Weekly Wrap Up (10/17/2025)

your go-to resource for fundamental updates

The crypto market experienced its largest single-day notional liquidation event last Friday after Trump announced another potential 100% tariff on China, re-igniting trade war fears in the broader market. While this was reversed shortly after, the fall-out from the news affected the entire crypto market and caused a cascade of liquidations that stress-tested perps and DeFi protocols more broadly.

As evident in the chart below, in a matter of hours, the entire crypto market lost over $800 Billion in market capitalization.

As a result, many traders and crypto-natives learned what ADL is. ADL, or auto-deleveraging, is a feature of perps in which shorts are closed without the consent of the users to keep perp exchanges solvent. In a large crash like the one experienced last Friday, certain shorts had to be closed prematurely; otherwise, there would not be enough longs to cover all the shorts. This mechanism demonstrates that perpetual exchanges are zero-sum in that for every positive trade, someone on the other side loses money.

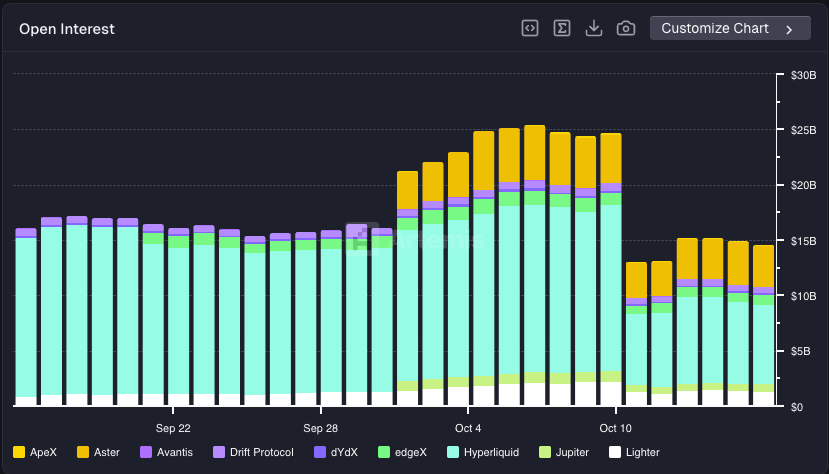

As a result of this event, the perp sector took a large beating. After last Friday’s crash, perps Open Interest dropped by almost 50%. Daily Open Interest fell from $25 Billion across all the perps we track to around $15 Billion.

There were many theories circulating on X on what caused this cascading risk and failure outside of just pure macro. The most plausible theory was an issue with Binance’s pricing of USDe. Many deduced that the main cause of the liquidation cascade stemmed from Binance, where USDe de-pegged. The cause was due to Binance’s pricing oracle, which had poor pricing controls around USDe and margin collateral, despite the fact that Ethena (the issuer of USDe) was solvent and continued to be over-collateralized.

https://x.com/KookCapitalLLC/status/1977465425459118534

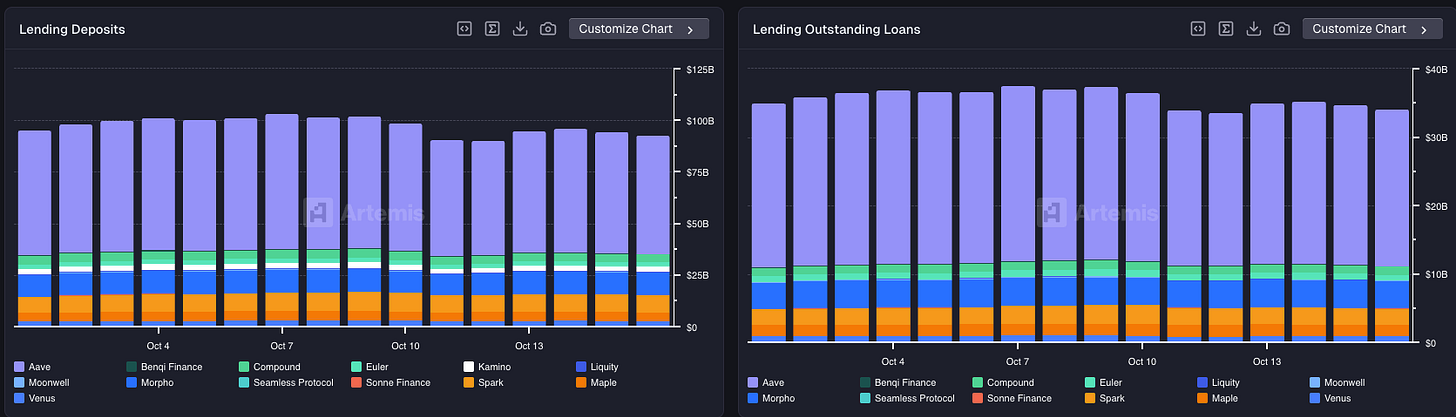

It’s hard to pinpoint the exact reason for the cascade of liquidations, as centralized exchanges (CEXs) are inherently opaque. But what is reassuring is that lending protocols such as Aave, Morpho, and Euler held strong and prevented any bad debt on their books while continuing to stay solvent. It should be noted though that Aave in fact pegged their USDe prices to USDT (which carries other types of risks) saved most of DeFi in this particular instance. As shown below, both deposits and outstanding loans (borrows) continued to stay high even after the liquidation event.

From our discussions with attendees at DAS, many institutions are more and more comfortable with the stability of DeFi and its ability (especially the lending protocols) to handle sudden crashes like Friday.

Gold Takes Center Stage and Regional Bank Distress

In other news, gold is becoming a hot topic across all markets.

Gold prices are on the rise, as people continue to center around the idea that the US dollar is decreasing in value rapidly as the Fed continues to print more T-bills. Seen as a safe haven from inflation and volatility, gold price has increased almost 30% over the last 3 months - and is up 60% over the last year.

US markets also seem wary of the potential fallout of regional banks under distress, as Zions Bancorporation (ZION) and Western Alliance (WAL) both plunge after disclosing problems with loans, adding broader concerns over credit stress. This is on top of the collapse of First Brands and car lender Tricolor in the last week which put Jefferies under scrutiny as the firm grappled with its exposure to First Brands.

https://www.ft.com/content/5cc3fad1-71a9-42ed-8e38-2cfcce57e16a

Fundraising News - Tradfi Bidding Crypto Native Firms

The past couple of weeks have shown an explosion of interest in investment from institutional capital into crypto and crypto-adjacent businesses. Below we highlight some of the most notable recent fundraises.

ICE, the owner of the New York Stock Exchange and a network of large exchanges worldwide, took a >20% stake in Polymarket, investing $2 Billion at a $9 Billion valuation.

Kalshi raised $300 Million co-led by Sequoia and a16z at a $5 Billion valuation.

And just today, Tempo raised $500 Million at a $5 Billion valuation from GreenOaks and Thrive Capital – yet another huge round for stablecoins and onchain payments!

https://x.com/DegenerateNews/status/1979220826877579526

What is clear is that although onchain assets and tokens might be hurting, institutions are seeing the benefits in crypto and being onchain, and many are investing a lot of cash into crypto native businesses.

This format and your blog posts are really nice! Please keep going :love: