Artemis Weekly Wrap Up (10/07/2025)

your go-to resource for fundamental updates

Hello everyone! Artemis Weekly Wraps are back but with a new author (or set of authors). After a small hiatus, we’re excited to re-launch our weekly newsletters to cover digital assets trends using Artemis data. New articles every Friday going forward!

Crypto markets continue to heat up as regulations become more favorable for crypto. The SEC announced broad frameworks for crypto ETFs and crypto products in general:

https://x.com/zoomerfied/status/1970472599734935846

https://x.com/zoomerfied/status/1968429875284279326

The broader markets have shown little reaction to the implications of a government shutdown as BTC briefly hit 125K and the S&P continues to record new record highs of 6750. Some argue that the government shutdown is a direct catalyst to BTC’s rapid jump to ~$125K (as noted by our own AI’s analysis). That being said, we wanted to highlight 3 major crypto trends this week involving: BNB, Perps, and Plasma.

BNB Season

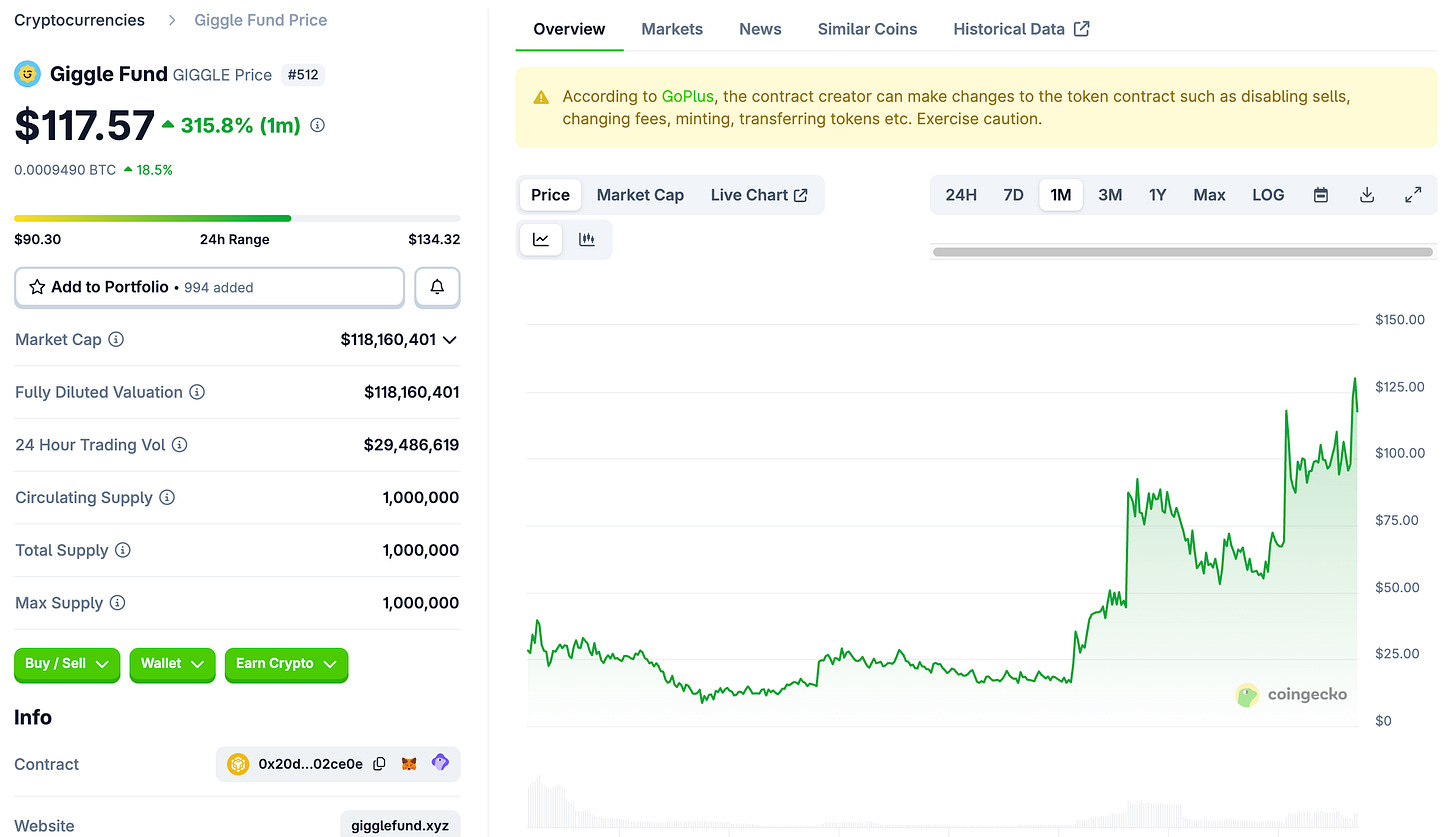

New launches on BNB chain have been experiencing rapid upwards price movement. What started as just Aster (a perpetual exchange that kicked off perp meta 2.0) has escalated to multiple tokens continually breaking into Coingecko’s top trending tokens table. At the moment of writing, “4”, a memecoin for BNB is up over 100% this past week, and GIGGLE is up over 90%. “4” is a BNB memecoin community that believes their token will go to 4 dollars, while GIGGLE is a memecoin dedicated to Binance GIGGLE Academy which is an initiative to help educate people on crypto.

PancakeSwap seems to be a clear winner as a result of the new demand for tokens on BNB. Being the dominant DEX on BNB, PancakeSwap has seen volumes increase rapidly – growing ~33% MoM – and continues to take market share from other DEX across the board, now accounting for ~34% of Monthly DEX Volumes across all the major DEX’s that Artemis tracks.

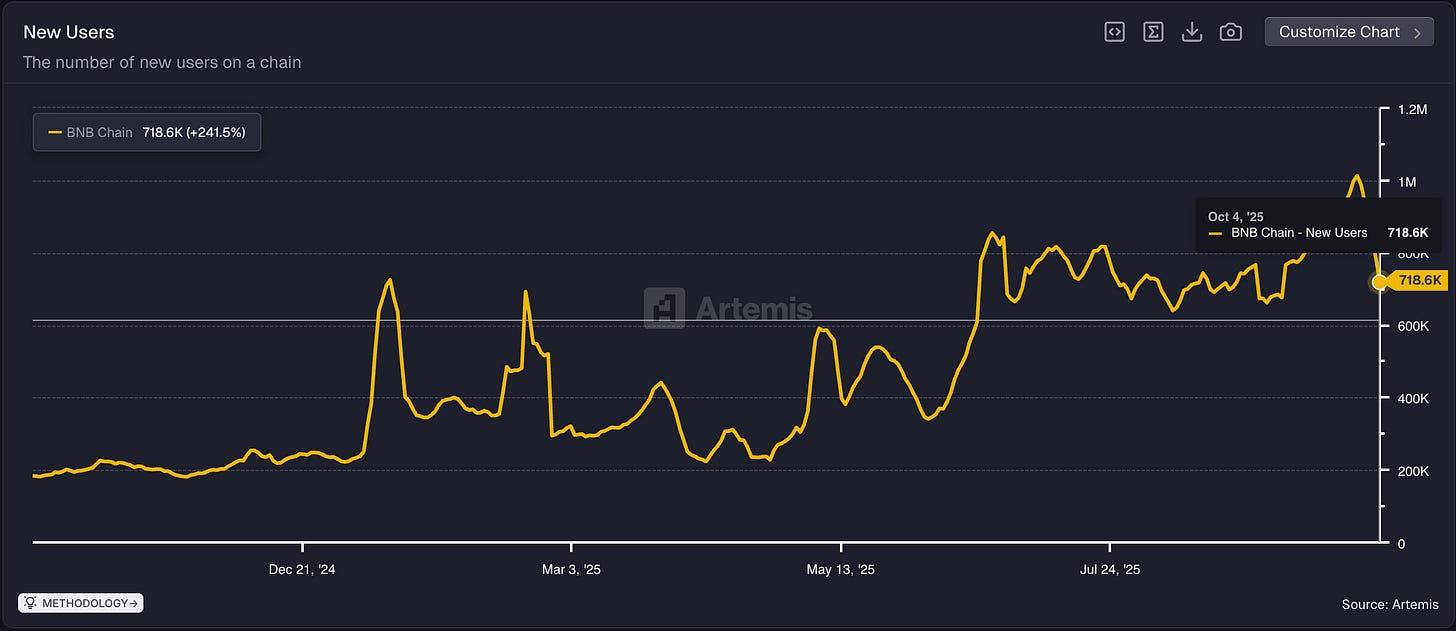

While a lot of this growth has been driven by memecoin mania, it can’t be understated how much the broader BNB Chain has grown over the past year.

New addresses on BNB experienced explosive growth - averaging over 500K the past month.

Retention of these addresses continues to be high, second only to Mantle

On-chain flows to BNB Chain also continue to ramp up with over $150 million in net flows in the last 3 months.

Furthermore, stablecoins on BNB have also reached a new all time high.

It is clear that BNB chain continues to be a dominate ecosystem in the broader crypto space and will be an ecosystem to track as Binance looks to potentially expand back into the US.

Perps Season 2.0

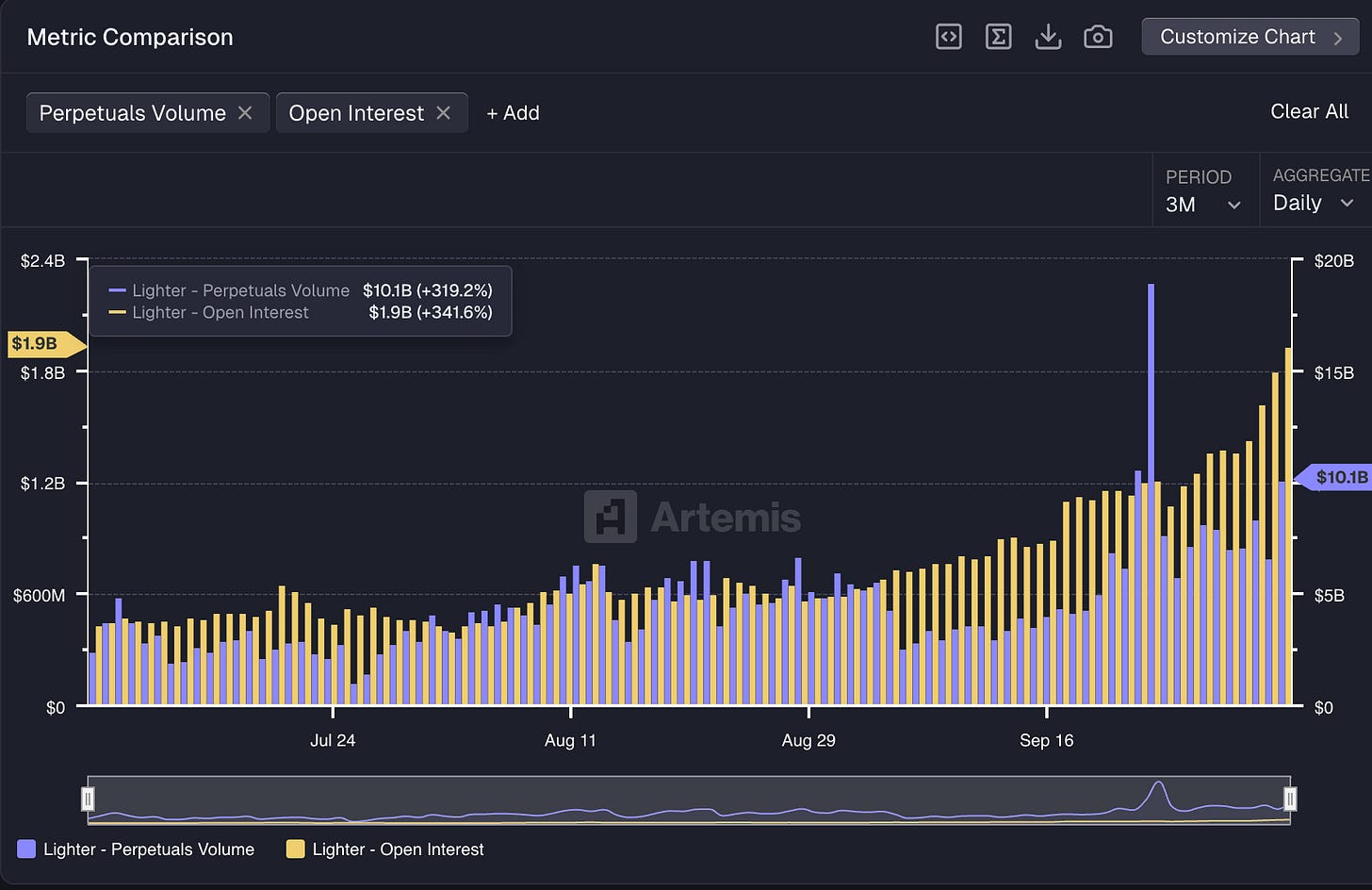

The launch of Aster – a perp DEX on BNB, backed by CZ – has kicked off general market fervor for Perpetual Exchanges and renewed talks about whether Hyperliquid dominance in this sector can be matched. Aster’s token meteoric price action and increase in perp volume have many believing that Hyperliquid’s once untouchable market share could be broken. Many other Perp Exchanges are seizing this renewed interest as perp volume continues to reach ATHs**.

** Please note that Aster Perp DEX Volume is being pulled from their API. There is uncertainty on the validity of volume, and we at Artemis advise all investors to do their own research. As such, we’ve provided two screenshots of the Perp DEX Volume (with and without Aster).

For those that are unfamiliar, Perpetual Exchanges allow users to trade Perpetual futures. Perpetual futures are a type of derivative contract that enables traders to speculate on the price of an asset—like Bitcoin, Ethereum, or other cryptocurrencies—without needing to buy or own the underlying asset itself.

Unlike traditional futures contracts, perpetual futures don’t have an expiration date, meaning traders can hold their positions indefinitely, as long as they maintain the required margin. Many traders like trading using Perps because of 2 main reasons.

1. There is no Expiration Date

A defining characteristic of perpetual futures is their exemption from an expiration date. With perpetual futures, there’s no deadline, so traders can hold their positions for as long as they want—provided they maintain enough margin in their accounts to hold the open positions.

2. Leverage Opportunities

Perpetual futures often allow for higher leverage, which means traders can control larger positions with a smaller amount of capital. For example, with 10x leverage, a trader can hold a $10,000 position with just $1,000 in capital. This ability to amplify exposure can lead to larger potential gains—but also comes with the risk of amplified losses. There are fees associated with borrowing this capital, often referred to as a funding rate.

You can learn more about them in this quick primer from Coinbase.

Artemis plans to release a long-form report on perpetual exchanges and how this broader ecosystem is doing as a whole compared to their CEX counterparts, but in the meantime, here are some key stats and charts about the top exchanges vying to take more market share from Hyperliquid. With Hyperliquid unlocks just around the corner, it will be important to see how much market share these new upstarts take from HYPE!

Lighter: A highly anticipated pre-TGE perp. Founded by Vladimir Novakovski.

edgeX: A little less known, but they are consistently making millions of dollars every day in fees!

ApeX: An exchange that is backed by Bybit and Mantle. Originally launched on Arbitrum, they have since gone multichain and have started to consistently manage over 1 billion in volume daily.

Plasma Launches

Congratulations to all those who participated in the launch of Plasma and XPL! It was a massive win for the larger ecosystem, as many early backers that got in pre-TGE were up anywhere from 20x to over 400x at the peak. Unlike other pre-sales, XPL was relatively open as largely anyone was able to participate in the pre-sale through venues like Coby’s EchoGroup.

A brief primer on Plasma - Plasma is a high-performance layer 1 blockchain purpose-built for stablecoins. Unlike other chains, stablecoin transfers on Plasma (specifically, USDT transfers) are completely free. With Tether being valued at $500 billion dollars in their latest funding round and stablecoin adoption accelerating at a breakneck pace with large software companies potentially launching their own (Cloudfare and potentially many more), it’s safe to say that stablecoins are going mainstream.

Now, let’s look at the numbers! Plasma L1 mainnet’s launch was one of the most successful Layer 1 launches in recent memory with over $5 billion of stablecoin supply minted at launch. It will be exciting to see how stablecoin activity continues to grow post the token and mainnet launch!

Stablecoin Transfers Volume continues to hold steady post-launch!

Cheers,

Son Do

The authors of this content, as well as affiliates of Artemis Analytics, may have financial interests in the protocols or tokens mentioned. This does not constitute investment advice or a recommendation to buy, sell, or hold any asset. The information provided is for educational purposes only and should not be relied upon for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. Views expressed may change without notice, and Artemis Analytics is not liable for any losses resulting from the use of this content.