Artemis Weekly Digital Finance Fundamentals 2026.01.16

This week we dive into the $18B crypto card boom, the Strive/Semler merger, Bitmine's pivot to viral "moonshots", and a surprising driver of growth in perps open interest.

Welcome back to Artemis’ Weekly Digital Finance Fundamentals!

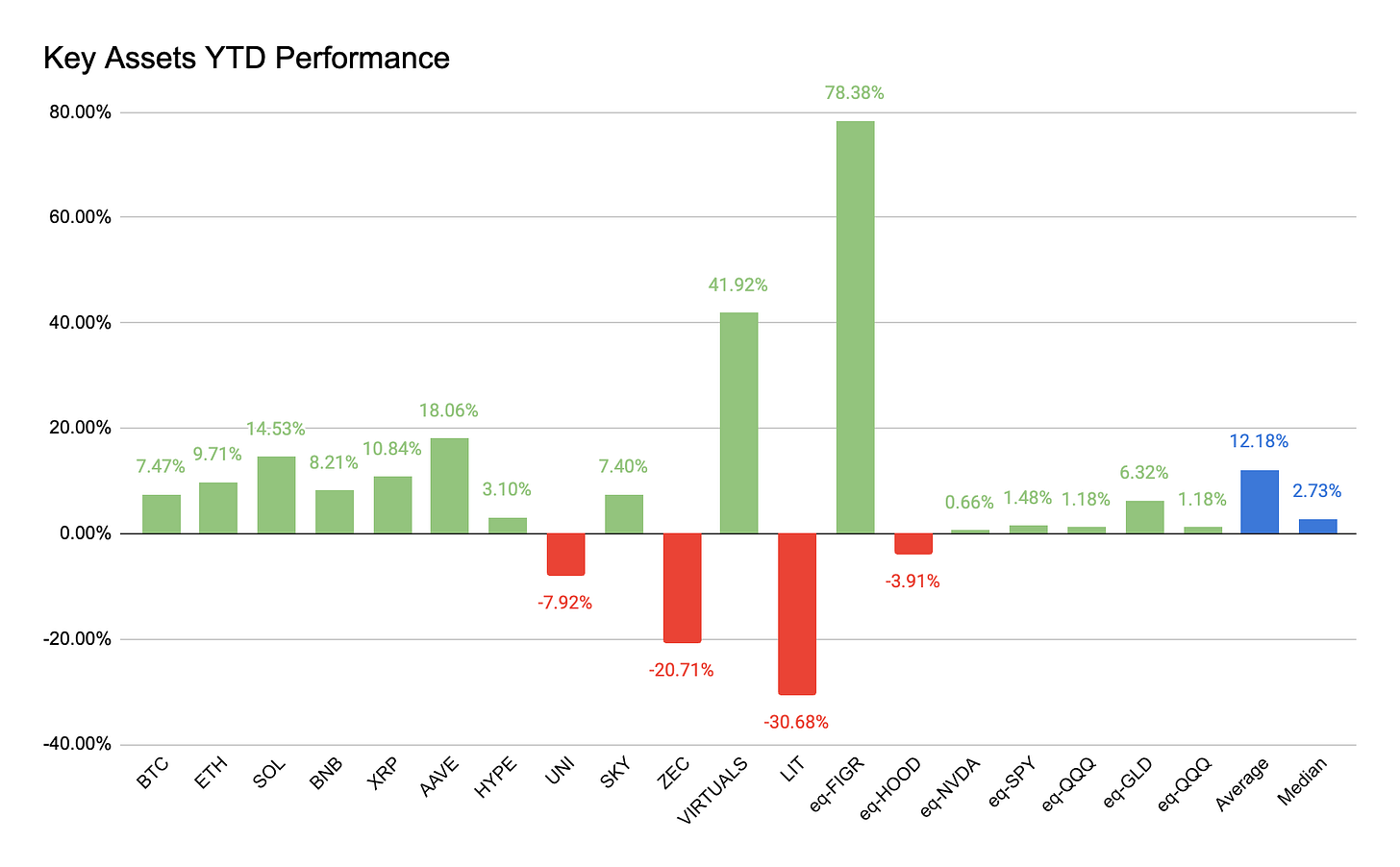

The market regained its footing in the second week of the year as BTC rose 7% to $95.4K and ETH surged 10% to settle around $3.3k; meanwhile, Gold notched a steady 3% gain. Other L1s like SOL (15%), BNB (8%) and XRP (11%) were up about 10% on average. Meanwhile, Figure continues to crush the year up a staggering 78% YTD, and Virtuals up 42% YTD on AI sector growth. Meanwhile, Lighter’s LIT token has fallen +30% this past week as BitMine hints at future partnership.

This week we’ll look into:

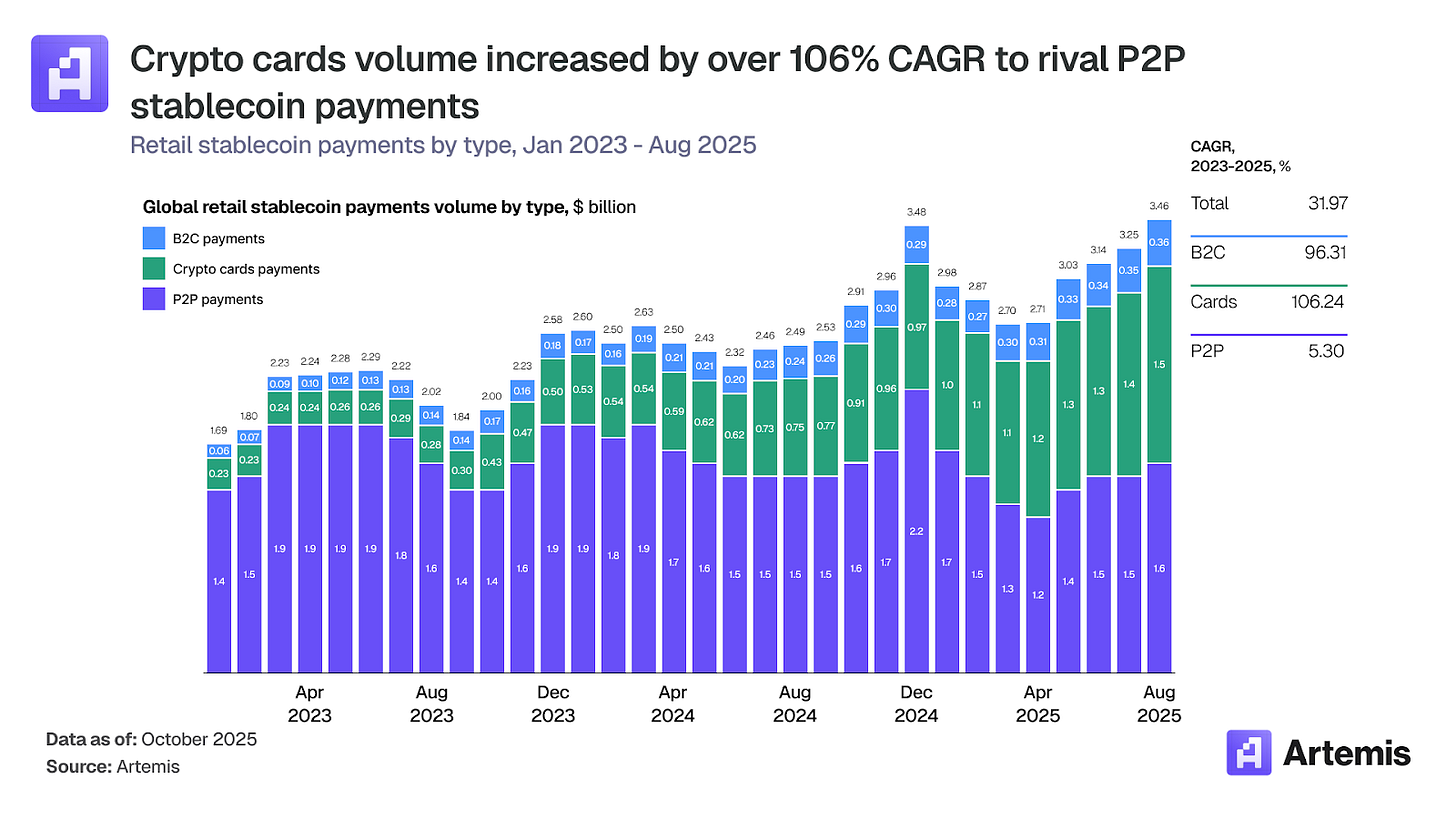

Crypto card volumes have compounded at 106% annually since January 2023, growing to $18B annualized volume in 2025.

Crypto’s Obsession with Buybacks

Strive Asset Management completes merger with Semler Scientific, marking the first DAT M&A.

Bitmine Immersion Technologies, invests $200M into Beast Industries and hosts annual shareholder meeting yesterday.

The rise of HIP-3 markets - RWAs coming onchain

Weekly Artemis Research Spotlight

Based on our recent research paper, Stablecoin Payments at Scale: How Cards Bridge Digital Assets and Global Commerce, a key insight is that crypto-linked card payments have effectively rivaled—and in some regions surpassed—peer-to-peer (P2P) stablecoin transfers as the primary driver of on-chain activity.

While P2P transfers have grown incrementally (just 5% over the last two years), crypto card spending has exploded at a 106% compound annual growth rate, reaching an annualized run rate of over $18 billion. This indicates a major structural shift: stablecoins are scaling globally not through native “crypto checkouts,” but by leveraging the familiar infrastructure of Visa and Mastercard to settle transactions behind the scenes. For developed markets, cards offer a low-friction path for high-value user segments to spend their digital asset balances seamlessly at over 150 million merchant locations.

Weekly Artemis Article Spotlight

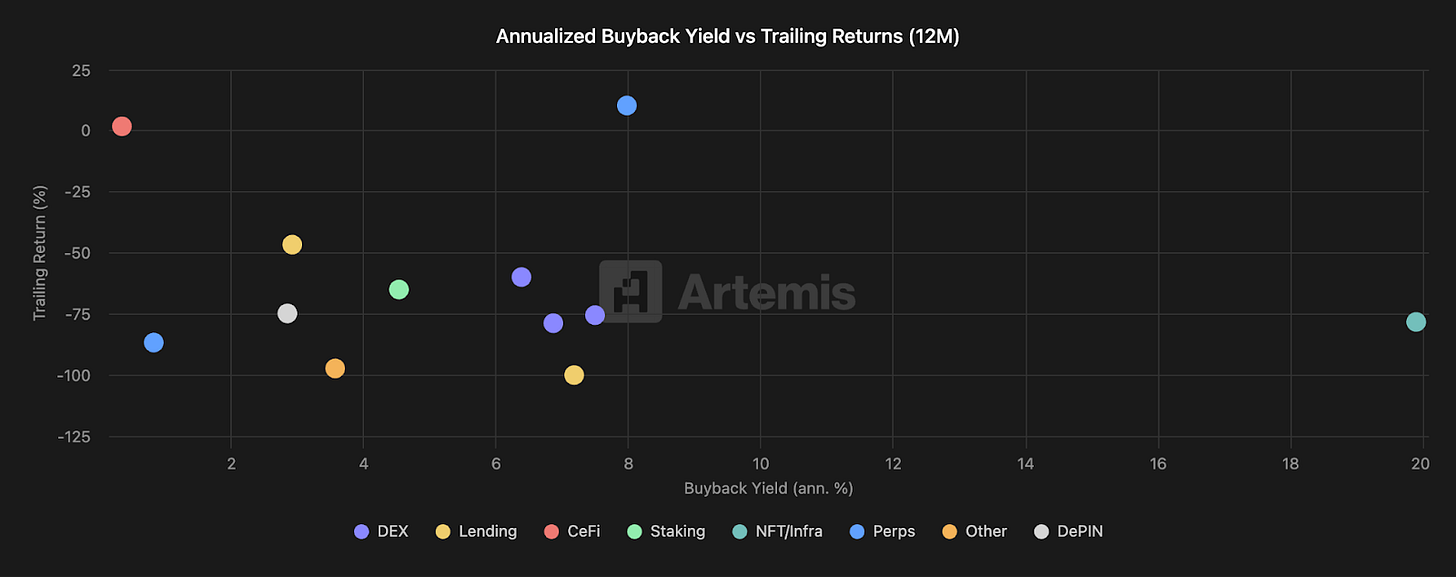

Our article Crypto’s Obsession with Buybacks argues that crypto treats buybacks like a “starter strategy” when they are supposed to be a late-stage capital allocation tool. In equities, buybacks come after a company has built something indispensable, reinvested heavily and become a durable cash machine. While many crypto protocols try to jump straight to returning capital before winning product-market fit, distribution and defensibility.

We showed “buyback yield ≠ returns” for most tokens (with Hyperliquid as a notable exception). We also explained why teams reach for buybacks anyway: tokenholders often lack legal claims, treasuries can become lootable honeypots and markets reward simple, immediate catalysts.

The main takeaway is to stop using buybacks to paper over weak token design and governance. Give the token a real job, put strong treasury guardrails in place - only then, token prices will actually be taken seriously.

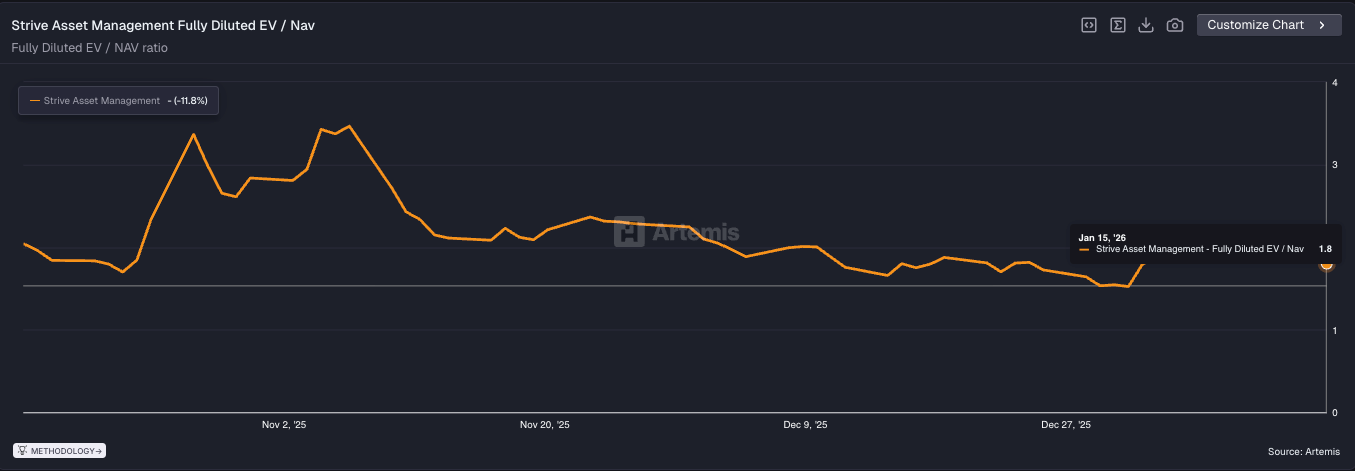

The days of being labeled as passive holders are over for DATs

The combination of Strive Asset Management ASST 0.00%↑ and Semler Scientific SMLR 0.00%↑ closed today, with the combined entity holding 12,798 Bitcoin. The leaderboards for corporate Bitcoin adoption just shifted as Strive now holds more Bitcoin than Tesla, Block and Trump Media Group. The deal was structured as an all-stock transaction where Semler shareholders received 21.05 shares of Strive for every share owned.

Alongside the closing, Strive executed a 1-for-20 reverse stock split across its Class A and B shares. This was a strategic move to ensure the stock remains eligible for institutional investors, with shares currently trading at approximately one dollar.

Beyond the expanded treasury, the merger introduces a unique dual-mandate operating strategy. Strive intends to continue monetizing Semler’s legacy healthcare business over the next year, specifically using those cash flows to pay off Semler’s existing debt

However, the current market price reflects some lingering uncertainty regarding how accretive this transaction actually was. At the time of the announcement, Semler was trading at a 0.8 mNAV while Strive was positioned around 2.0 mNAV. Since the exact details of the transaction have not yet been released, the market seems to be in a wait-and-see mode, with shares remaining relatively flat as investors digest the news.

The combined Strive entity now has two operating businesses: ETF management and healthcare, and a preferred stock SATA 0.00%↑ funding future Bitcoin accumulations. DATs are shaping up to be complex corporate entities .

While this consolidation could spark a broader trend of M&A among Digital Asset Treasuries, especially for those trading at a significant discount to NAV, it is likely not the start of a flood in M&A. Given that this transaction took nearly five months to close, we should probably only expect a handful of similar DAT mergers to materialize in the near future.

Bitmine makes a play on virality and “moonshots”

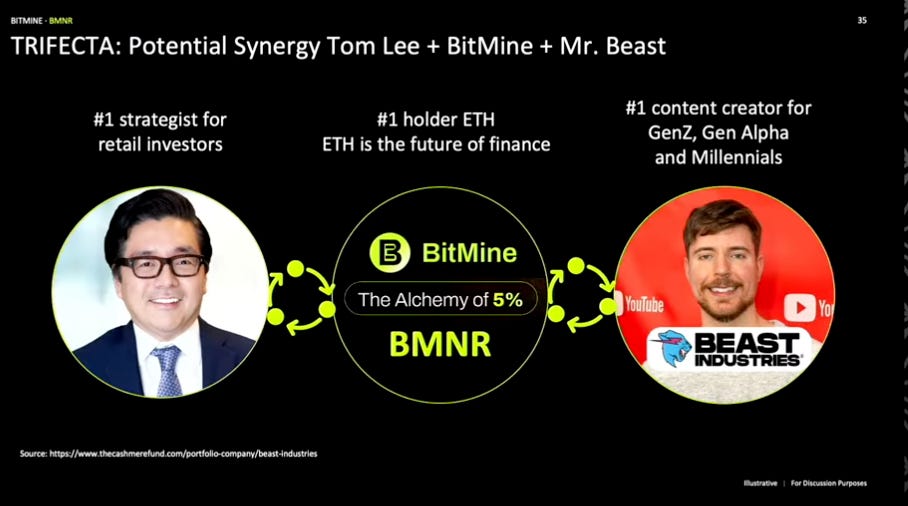

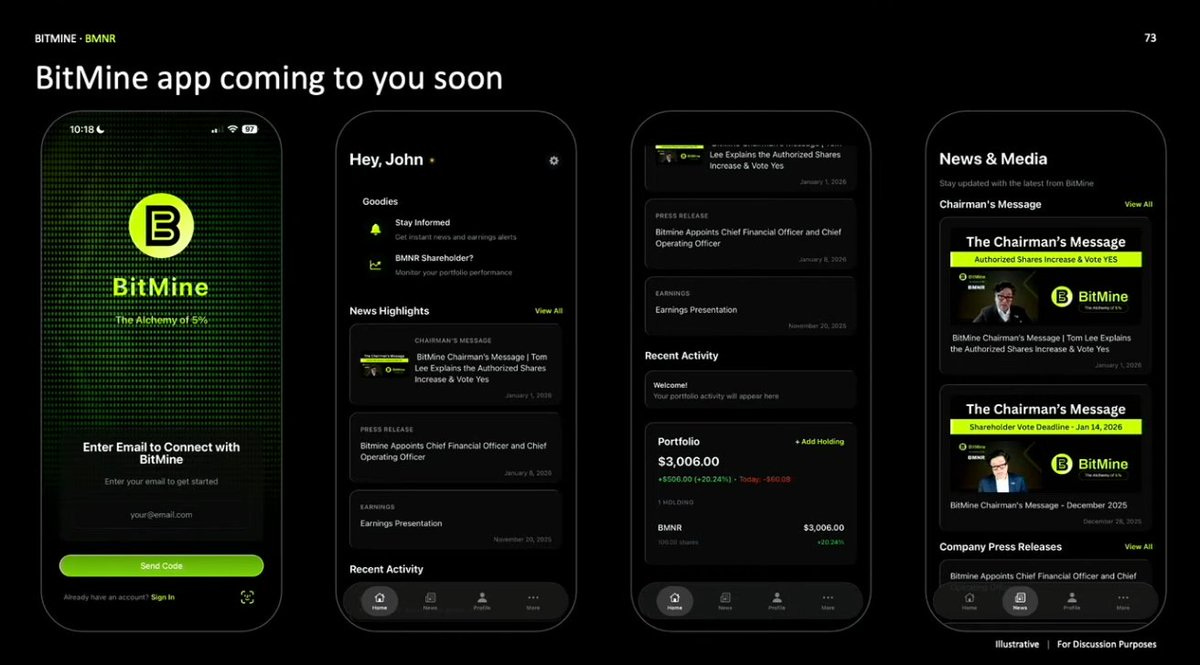

In a surprising set of moves at their annual shareholder meeting yesterday at the Wynn Las Vegas, Bitmine Immersion — the largest corporate holder of ETH —- made a $200M equity investment in Beast Industries. For those unfamiliar, Beast Industries is the entertainment and consumer packaged goods company founded by MrBeast. Tom Lee described this as a strategic play for unmatched reach, targeting the 450 million subscribers and 5 billion monthly views across the MrBeast ecosystem.

Bitmine plans to act as the backend for a new financial services platform, integrating DeFi-enabled products into MrBeast’s audience of Gen Z and Gen Alpha users. Tom Lee continues to show his unconventional approach to strategy with this particular moonshot, explicitly stating he expects a 10x return on the investment. To support this vision of productizing the treasury, Lee also highlighted the Lighter protocol as a key "moonshot" partner, specifically aiming to use their infrastructure to tokenize traditional Wall Street assets.

Users on X are conflicted, with some showing confusion on the need to spend money developing an app and investing in Beast Industries instead of just buying more ETH. Bitmine currently owns 4.17 million ETH, representing approximately 3.45% of the total global Ethereum supply, leading many to wonder if these moonshots are a derailment of the core ETH strategy.

Several unknowns remain for both the app and the potential synergies here, but supporters point to Tom Lee’s successful calls on Wall Street in the last few years. Time will tell if the investment becomes the success Lee describes, but one thing is for sure: DATs are becoming much more than just HODLers.

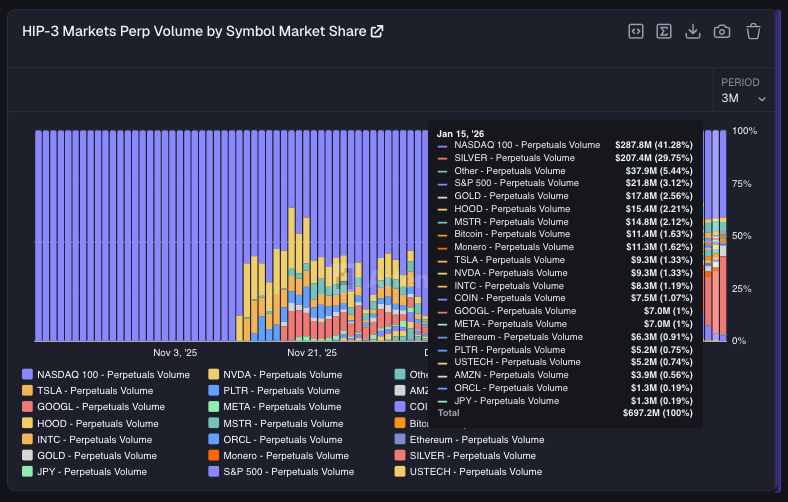

The Perp-ification of Everything: RWAs Hit All-Time Highs

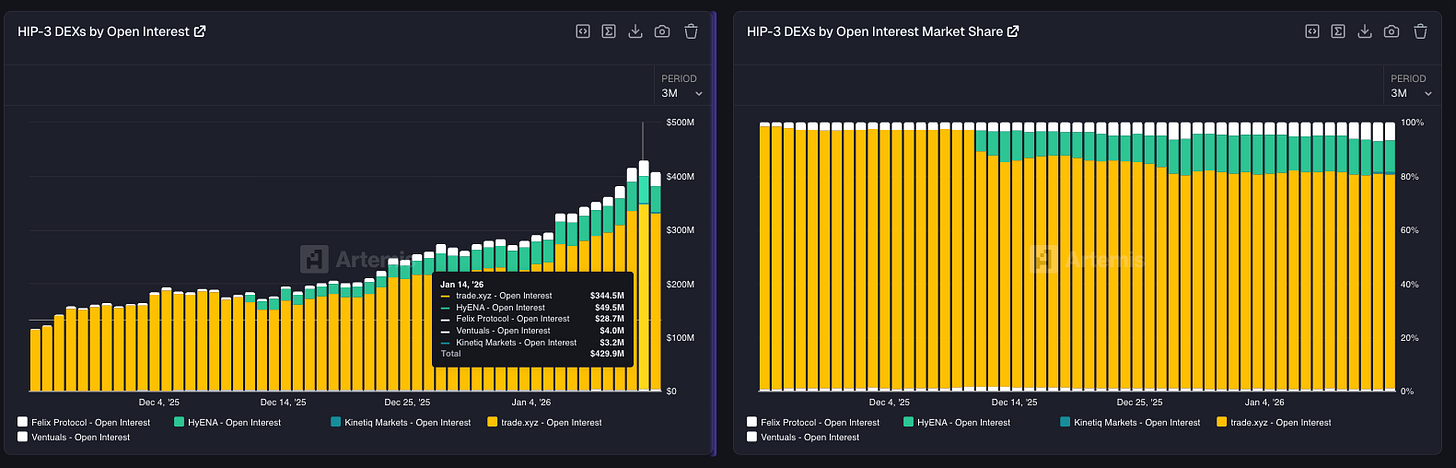

The "HIP-3" perpetual market is exploding, with open interest hitting a fresh all-time high of $430M. This growth isn't just coming from native crypto assets; it’s being fueled by a massive shift into on-chain Real World Assets (RWAs).

Across venues like trade.xyz, Felix, and HyENA, traders are moving beyond BTC and ETH to trade the Nasdaq 100, Gold, Silver, and tech giants like NVDA and TSLA.

What’s interesting is what people are trading: it’s not just crypto anymore - volume are increasingly driven by onchain “RWA” markets like indices (Nasdaq 100, S&P 500), commodities (Silver, Gold) and even single-name equities like HOOD, MSTR, TSLA, NVDA, COIN.

The main takeaway is: as more real-world assets come onchain, the perp stack is turning into a 24/7 global macro + equities casino.

The liquidity is slowing building.

Thanks for reading Artemis’ Weekly Digital Finance Fundamentals. As always, stay curious, and we'll see you next week!

Disclaimer: The authors of this content, as well as affiliates of Artemis Analytics, may have financial interests in the protocols or tokens mentioned. This does not constitute investment advice or a recommendation to buy, sell, or hold any asset. The information provided is for educational purposes only and should not be relied upon for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. Views expressed may change without notice, and Artemis Analytics is not liable for any losses resulting from the use of this content.

Great article super informative, I liked all the graphs you guys used!