Artemis Weekly Digital Finance Fundamentals 2026.01.06

Happy New Years to all our readers and welcome back to Artemis’ Weekly Digital Finance Fundamentals!

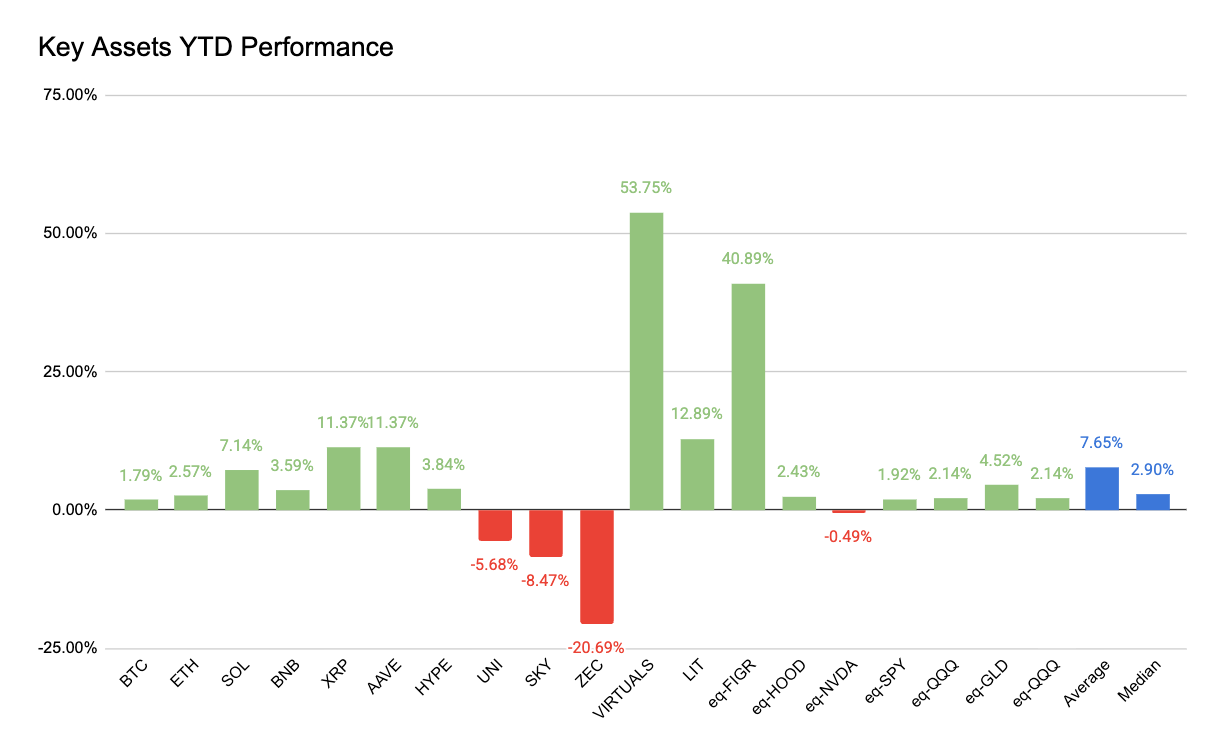

The market welcomed the new year with open arms (for the most part). BTC retook $90k, ETH climbed above $3k, and Gold pushed all time highs. Other L1s like SOL, BNB and XRP were up about 10% on average. Meanwhile, Figure opened the year up a staggering 42%, and Virtuals up 55% on AI sector growth. UNI opened the year down 5.68% in spite of the implementation of the UNIfication plan and ZEC dropped 20% on governance related drama.

This week we’ll look into:

The Aave drama

Figure’s explosive growth

The topic of buybacks

The state of DATs going into 2026

Aave: Who controls a protocol?

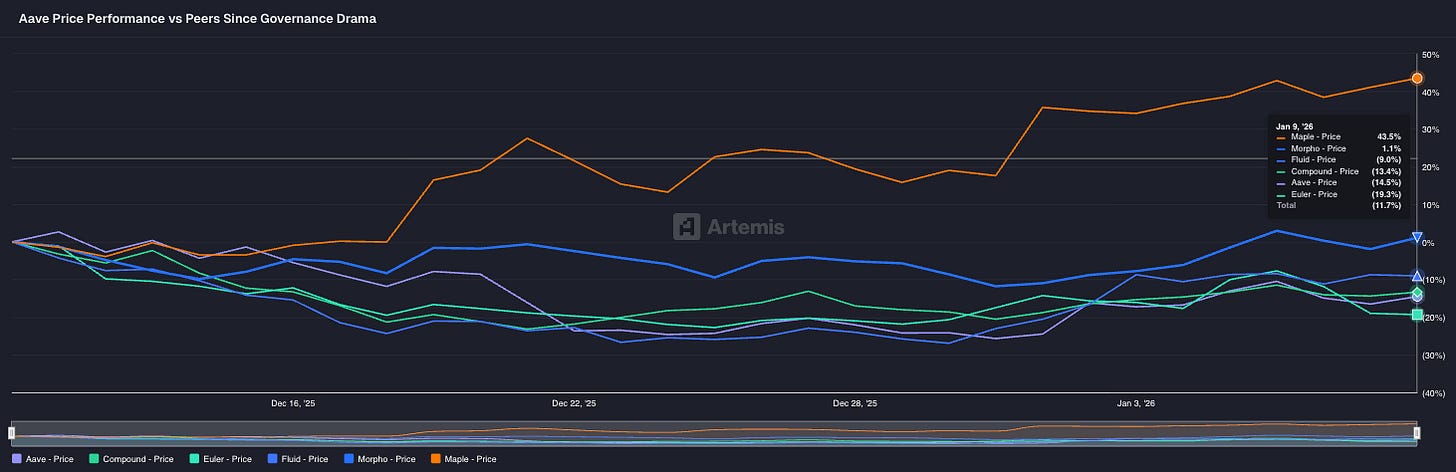

Just as the SEC dropped its investigation into the decentralized lending protocol, internal drama took hold of the Aave community. Spurred by a community member observation that Aave’s frontend swap fees had stopped being sent to the DAO and were now being sent to Aave Labs, the Aave community has been in a frenzy for weeks. The crux of the discussion has been around who controls what in the Aave ecosystem? Can Aave Labs arbitrarily redirect frontend swap fees to themselves and away from the DAO? Who really owns the IP - and who can leverage it for profit?

The discussion has been extensive, so we recommend you see this post from rekt.news for a deep rundown of everything that has happened.

With the AAVE token down as much as 25% since the beginning of the infighting, its clear that many investors are grappling with the same question around control of a protocol. A protocol is much more than its smart contracts: its the brand, the front end, the social presence, and the partnerships. How the value that each creates is distributed is still being determined.

We are optimistic about tokens, and believe that Aave is one of the most important protocols/tokens in the space. It is vital that the DAO and the token are able to capture value from the protocol (they do via interest revenue and other mechanisms) and that service providers like Aave Labs are remunerated for their contributions so the product/ecosystem can continue to grow. We’re closely watching this situation as the community awaits a structured proposal from Stani and Aave Labs on next steps.

Figure

Figure began 2025 with impressive 40%+ gains, significantly outperforming the broader mortgage finance industry’s 15-20% increase as mortgage rates dropped to their lowest levels since 2024.

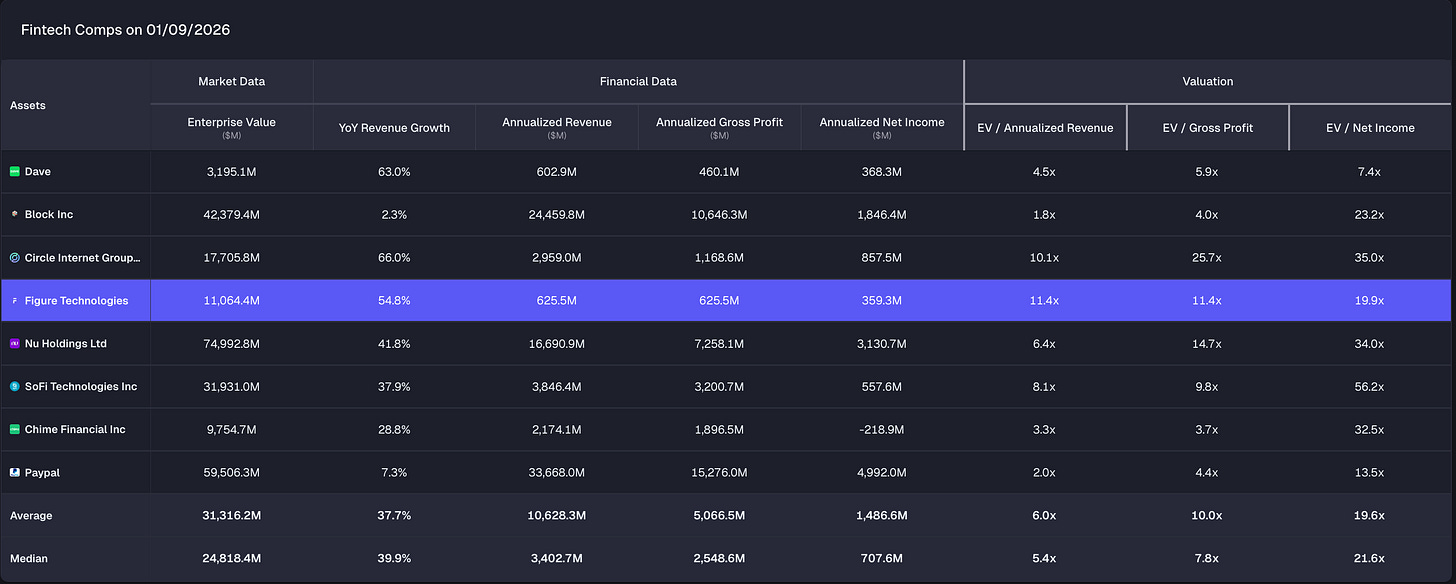

With ~$500M in revenue and strong 50% year-over-year growth, Figure leverages its proprietary Provenance Blockchain to streamline the entire credit cycle, reducing loan origination costs from the industry standard of $11-12K to roughly $1K per loan while compressing time-to-close from weeks to days. This efficiency advantage allows Figure to profitably serve smaller loan segments that traditional lenders avoid, creating new addressable market opportunities rather than just competing for existing volume.

Figure is one of the fastest-growing companies in the crypto-adjacent world (note these metrics are using last quarter metrics and annualizing them).

The company’s strategic expansion beyond direct lending into Figure Connect—a blockchain-native marketplace for tokenized loans—represents the next phase of growth driving investor enthusiasm. With $3 billion in marketplace transaction volume since mid-2024 launch and partnerships enabling both direct-to-consumer and B2B2C distribution models, Figure is positioned to capture a larger share of the $35 trillion U.S. home-equity market.

Check out our analyst Tiago Souza’s full Figure analysis here for price targets and a deeper discussion of the business.

Buybacks

Buybacks captured the zeitgeist of Twitter once again this past week as leaders from both Jupiter and Helium publicly considered their downside.

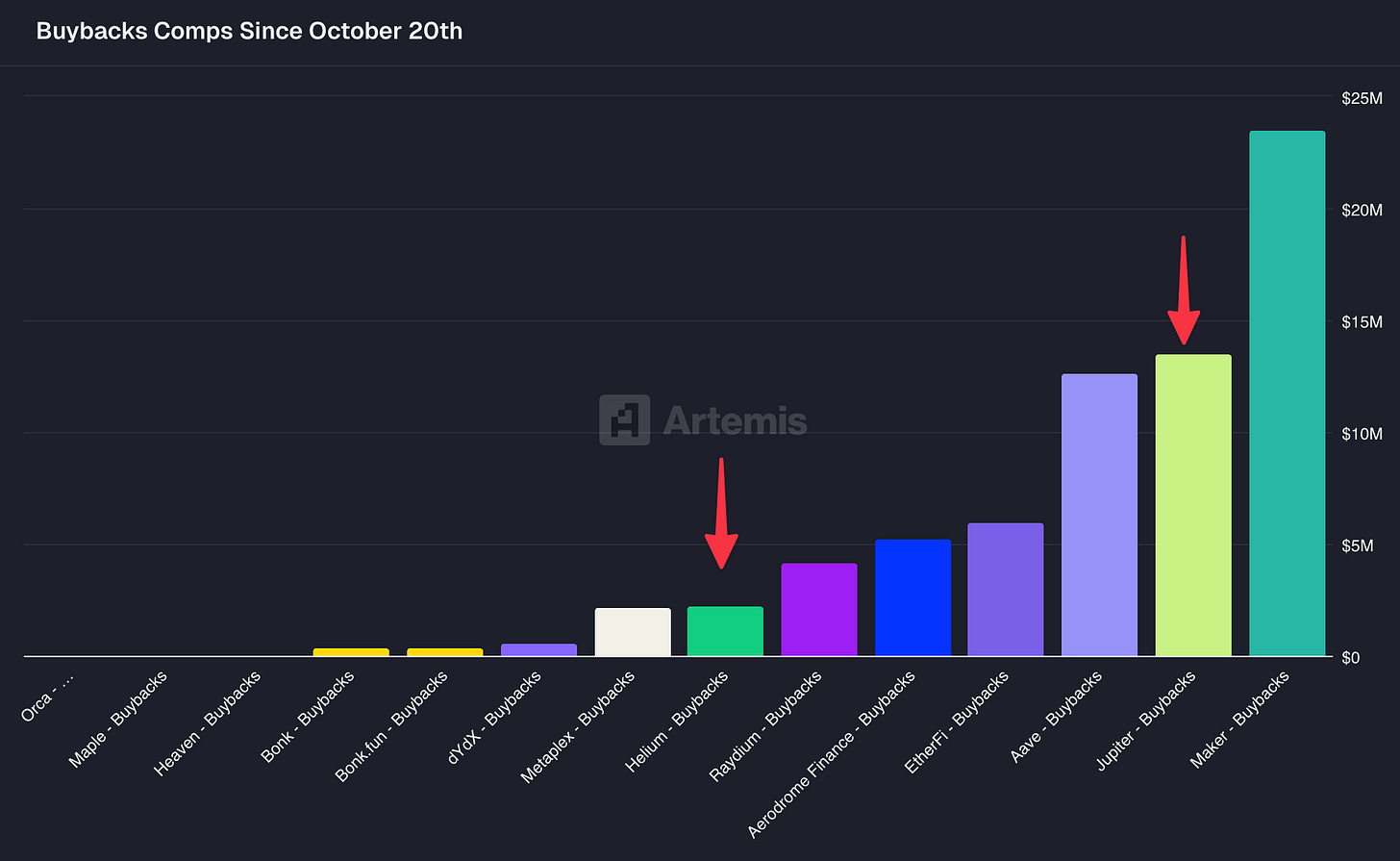

Helium recently announced that they are fully winding down their buyback program which started on October 20th of last year. Through the length of the program, Helium spent $2.3m on HNT token buybacks. Now, Amir Haleem, Helium’s cofounder, feels that they are “wasting [their] money” and has halted the program (X/amirhaleem).

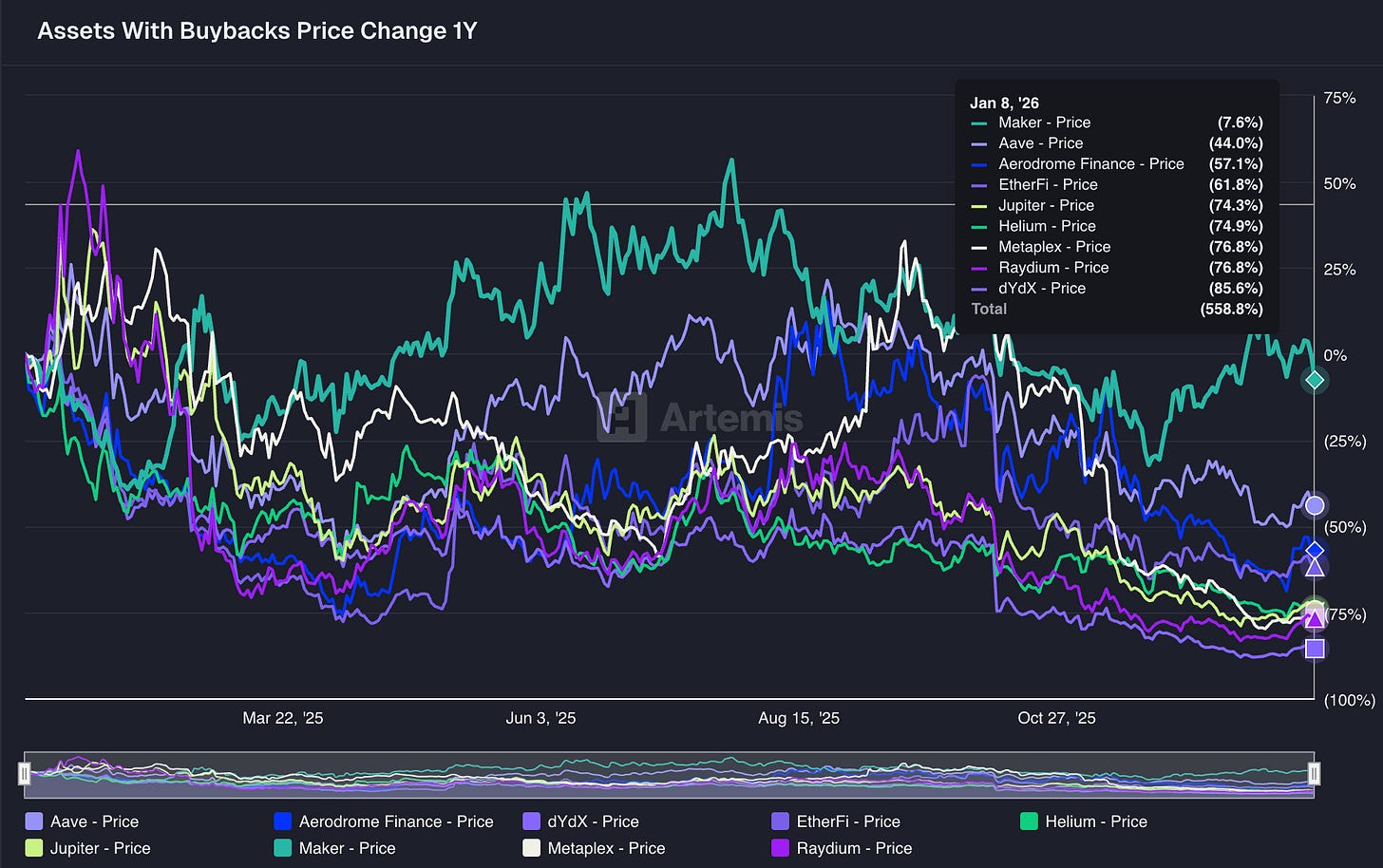

Amir and the Helium team ignited the conversation, and now, leaders in the space are second guessing the impact of buybacks. Notably, Jupiter founder Siong Ong posed the question to the community - should Jupiter stop doing buybacks? Among major protocols, Jupiter and Helium rank 2nd and 7th, respectively, for total buybacks since October 20th (when HNT buybacks began). Buybacks have typically been seen as a way to return value to tokenholders, since dividends put tokens in securities-violation territory. Siong and Amir both noted that buybacks have not meaningfully supported price over the past several months, and that the market does not seem to be rewarding this mechanism of value distribution. That thought is supported by the data:

As we can see above, major tokens that had buyback programs are down between 44 and 85 percent, in line with the broader alt-coin market (with the exception of Maker/Sky). Buybacks were largely seen as a way for the team to share revenue with the tokenholders. However, if we consider that these protocols are all largely fledgling startups, it often does not make sense that they spend their revenues on buybacks. Startups in those stages should be focusing all their energy and capital into growth. Asset buybacks should be done strategically, not indiscriminately. We expect many protocol teams to follow suit here and begin allocating more capital into growth.

Digital Asset Treasuries: 2026 Performance Overview

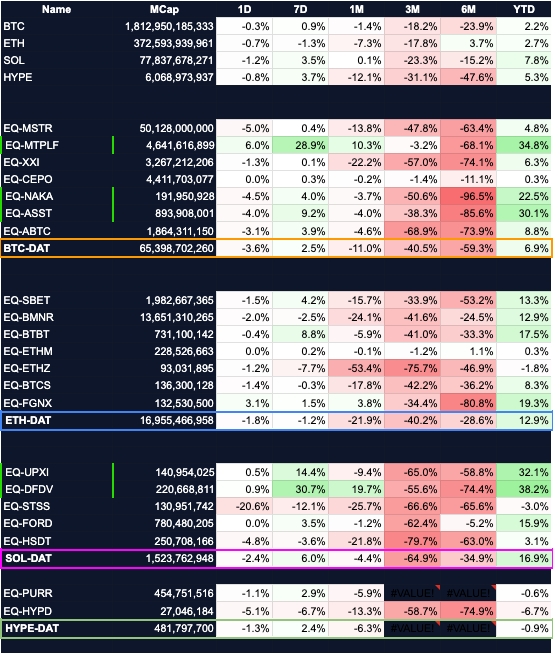

The market welcomed the new year with a explosive start for Digital Asset Treasuries (DATs), signaling a potential “mean-reversion” year after a punishing 2025 where the sector saw declines of 40-80%. The top-performing assets in the first week of 2026 include $DFDV (+38.2%), $MTPLF (+34.8%), and $UPXI (+32.1%), significantly outperforming the broader market.

Solana-based DATs have emerged as the clear ecosystem leaders, posting an average return of approximately 17%. This strength is closely tied to the SOL token, which gained 7.8% year-to-date and outpaced its major layer-one competitors. In contrast, HYPE DATs have lagged behind with a disappointing average return of -0.9%.

Charts of the Week

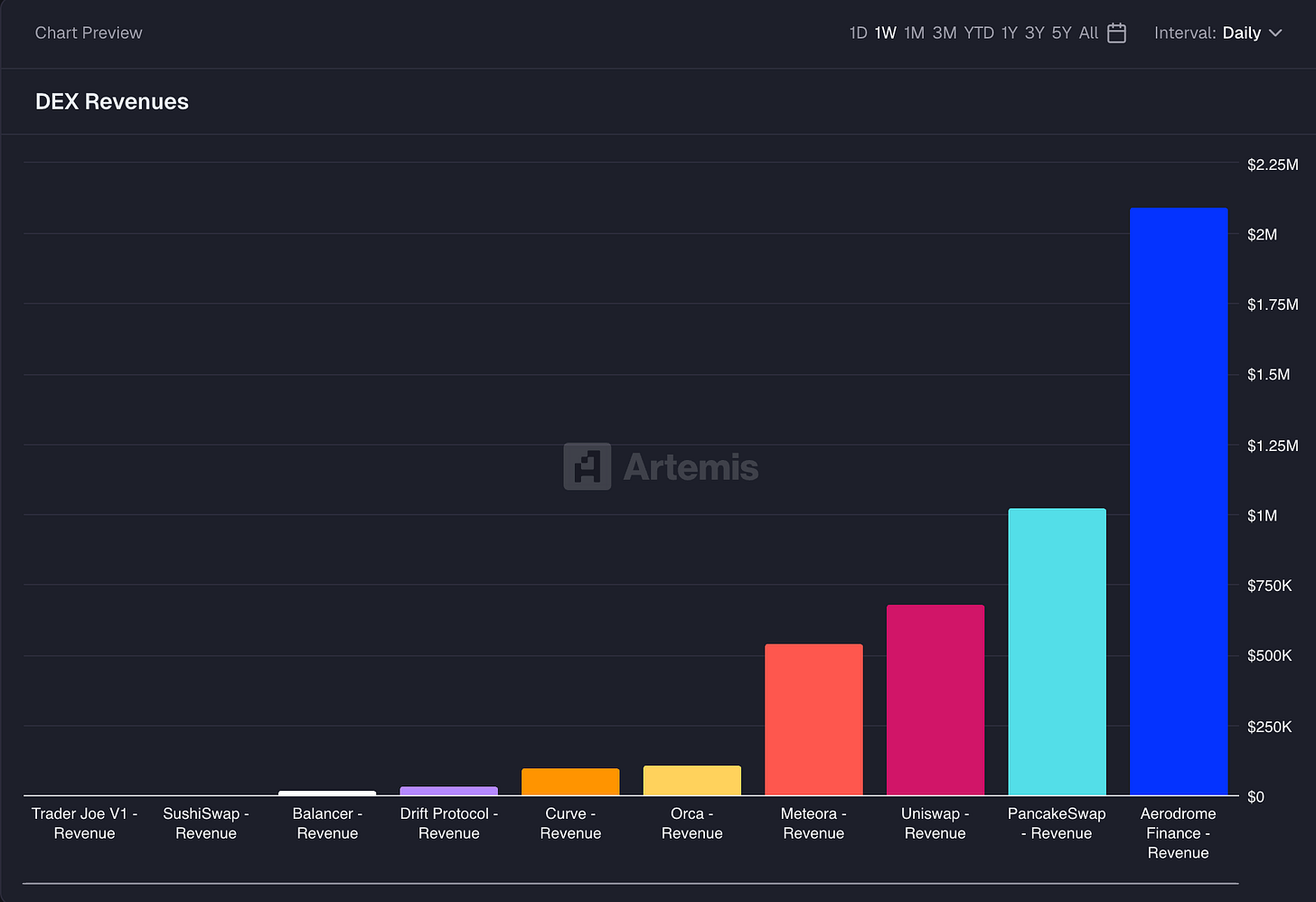

Uniswap activated its fee switch across select products, generating ~25m run-rate revenue for the token, ranking Uniswap at #3 in trailing 7D DEX token revenue.

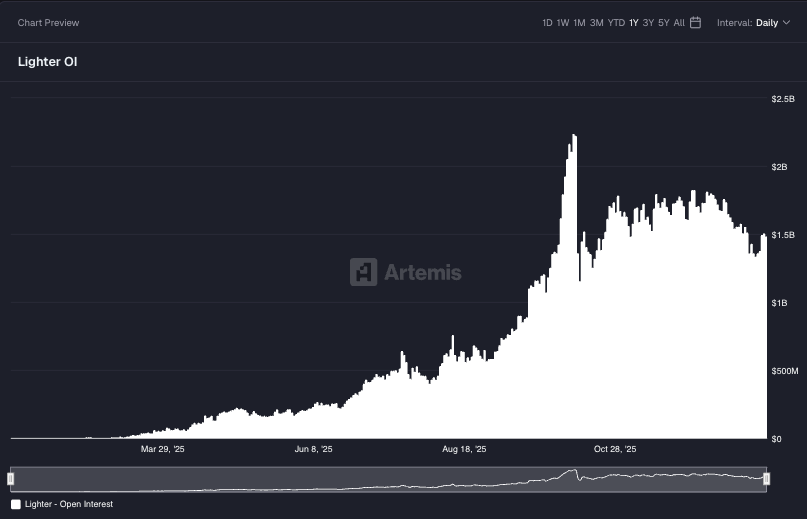

Lighter launches LIT token, open-interest remains high.

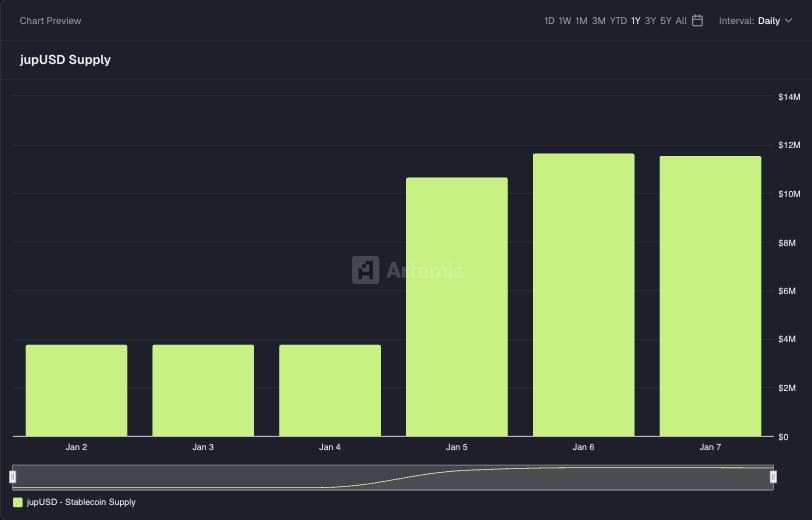

Jupiter launches BUIDL-backed jupUSD as it continues to build out a fully featured DeFi platform now comprised of: swaps, lending, perps, stablecoin, launchpad, predictions, and more.

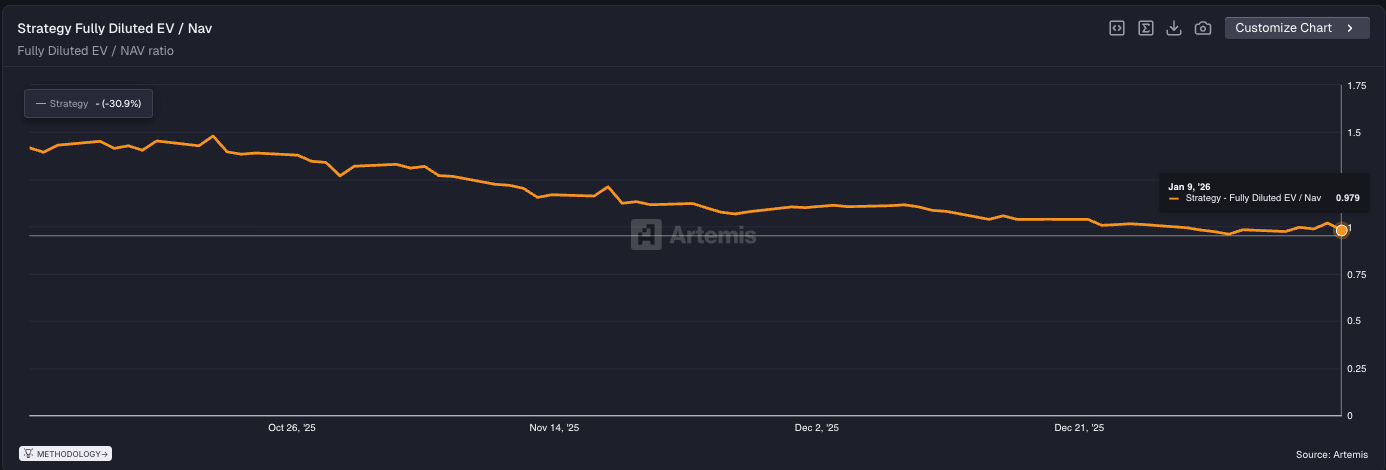

Strategy trades below a fully diluted mNAV of 1 for 9 of the last 30 days.

Other notable news:

The Senate has slated a markup of the CLARITY act for January 15th.

MSCI chooses not to exclude DATs from indices, MSTR jumps 7% on the news

Disclaimer: The authors of this content, as well as affiliates of Artemis Analytics, may have financial interests in the protocols or tokens mentioned. This does not constitute investment advice or a recommendation to buy, sell, or hold any asset. The information provided is for educational purposes only and should not be relied upon for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. Views expressed may change without notice, and Artemis Analytics is not liable for any losses resulting from the use of this content.